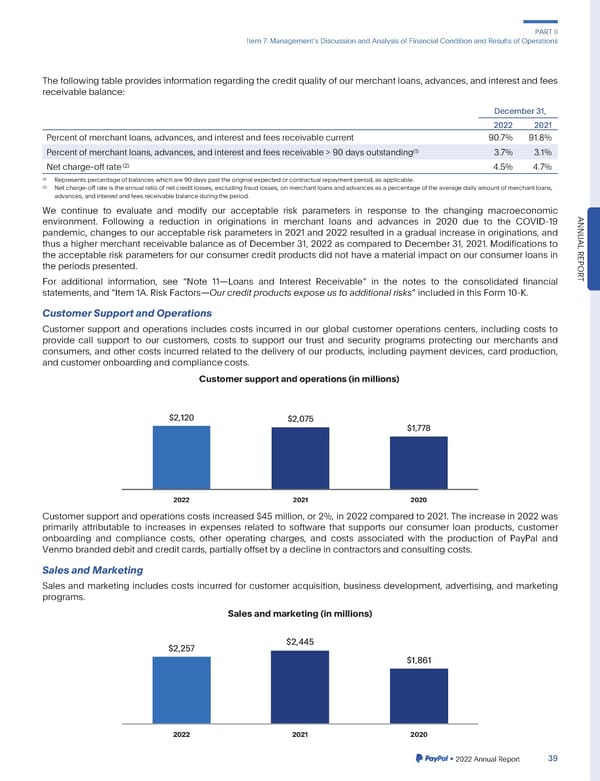

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations Thefollowingtableprovidesinformationregardingthecreditqualityof our merchantloans,advances,andinterestandfees receivablebalance: December31, 2022 2021 Percentofmerchantloans,advances,andinterestandfeesreceivablecurrent 90.7% 91.8% (1) Percentofmerchantloans,advances,andinterestandfeesreceivable>90daysoutstanding 3.7% 3.1% Netcharge-offrate(2) 4.5% 4.7% (1) Representspercentageofbalanceswhichare90dayspasttheoriginalexpectedorcontractualrepaymentperiod,asapplicable. (2) Netcharge-offrateistheannualratioofnetcreditlosses,excludingfraudlosses,onmerchantloansandadvancesasapercentageoftheaveragedailyamountofmerchantloans, advances,andinterestandfeesreceivablebalanceduringtheperiod. We continue to evaluate and modify our acceptable risk parameters in response to the changing macroeconomic environment. Following a reduction in originations in merchant loans and advances in 2020 due to the COVID-19 ANNU pandemic, changes to our acceptable risk parameters in 2021 and 2022 resulted in a gradual increase in originations, and thus a higher merchant receivable balance as of December 31, 2022 as compared to December 31, 2021. Modifications to AL the acceptable risk parameters for our consumer credit products did not have a material impact on our consumer loans in REPOR theperiodspresented. For additional information, see “Note 11—Loans and Interest Receivable” in the notes to the consolidated financial T statements,and“Item1A.RiskFactors—Ourcreditproductsexposeustoadditionalrisks”includedinthisForm10-K. CustomerSupportandOperations Customer support and operations includes costs incurred in our global customer operations centers, including costs to provide call support to our customers, costs to support our trust and security programs protecting our merchants and consumers, and other costs incurred related to the delivery of our products, including payment devices, card production, andcustomeronboardingandcompliancecosts. Customer support and operations (in millions) $2,120 $2,075 $1,778 2022 2021 2020 Customersupportandoperationscostsincreased$45 million, or 2%, in 2022 comparedto 2021. The increasein 2022 was primarily attributable to increases in expenses related to software that supports our consumer loan products, customer onboarding and compliance costs, other operating charges, and costs associated with the production of PayPal and Venmobrandeddebitandcreditcards,partiallyoffsetbyadeclineincontractorsandconsultingcosts. SalesandMarketing Sales and marketing includes costs incurred for customer acquisition, business development, advertising, and marketing programs. Sales and marketing (in millions) $2,257 $2,445 $1,861 2022 2021 2020 •2022AnnualReport 39

2023 Annual Report Page 186 Page 188

2023 Annual Report Page 186 Page 188