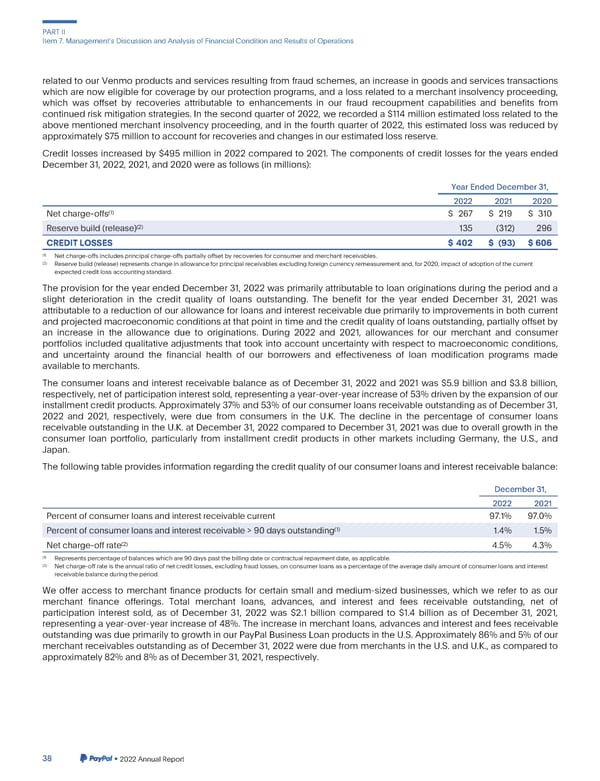

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations related to our Venmo products and services resulting from fraud schemes, an increase in goods and services transactions which are now eligible for coverage by our protection programs, and a loss related to a merchant insolvency proceeding, which was offset by recoveries attributable to enhancements in our fraud recoupment capabilities and benefits from continued risk mitigation strategies. In the second quarter of 2022, we recorded a $114 million estimated loss related to the above mentioned merchant insolvency proceeding, and in the fourth quarter of 2022, this estimated loss was reduced by approximately$75milliontoaccountforrecoveriesandchangesinourestimatedlossreserve. Credit losses increased by $495 million in 2022 compared to 2021. The components of credit losses for the years ended December31,2022,2021,and2020wereasfollows(inmillions): YearEndedDecember31, 2022 2021 2020 (1) Netcharge-offs $ 267 $ 219 $ 310 (2) Reservebuild(release) 135 (312) 296 CREDITLOSSES $ 402 $ (93) $606 (1) Netcharge-offsincludesprincipalcharge-offspartiallyoffset by recoveriesfor consumerandmerchantreceivables. (2) Reservebuild(release)representschangeinallowanceforprincipalreceivablesexcludingforeigncurrencyremeasurementand,for2020,impactofadoptionofthecurrent expectedcreditlossaccountingstandard. The provision for the year ended December 31, 2022 was primarily attributable to loan originations during the period and a slight deterioration in the credit quality of loans outstanding. The benefit for the year ended December 31, 2021 was attributable to a reduction of our allowance for loans and interest receivable due primarily to improvements in both current andprojectedmacroeconomicconditionsatthatpointintimeandthecreditqualityofloansoutstanding,partiallyoffsetby an increase in the allowance due to originations. During 2022 and 2021, allowances for our merchant and consumer portfolios included qualitative adjustments that took into account uncertainty with respect to macroeconomic conditions, and uncertainty around the financial health of our borrowers and effectiveness of loan modification programs made available to merchants. The consumer loans and interest receivable balance as of December 31, 2022 and 2021 was $5.9 billion and $3.8 billion, respectively,net of participation interest sold, representing a year-over-year increase of 53% driven by the expansion of our installment credit products. Approximately 37% and 53% of our consumer loans receivableoutstandingas of December31, 2022 and 2021, respectively, were due from consumers in the U.K. The decline in the percentage of consumer loans receivable outstanding in the U.K. at December 31, 2022 compared to December 31, 2021 was due to overall growth in the consumer loan portfolio, particularly from installment credit products in other markets including Germany, the U.S., and Japan. Thefollowingtableprovidesinformationregardingthecreditqualityofourconsumerloansandinterestreceivablebalance: December31, 2022 2021 Percentofconsumerloansandinterestreceivablecurrent 97.1% 97.0% (1) Percentofconsumerloansandinterestreceivable>90daysoutstanding 1.4% 1.5% (2) Netcharge-offrate 4.5% 4.3% (1) Representspercentageofbalanceswhichare90dayspastthebillingdateorcontractualrepaymentdate,asapplicable. (2) Netcharge-offrateistheannualratioofnetcreditlosses,excludingfraudlosses,onconsumerloansasapercentageoftheaveragedailyamountofconsumerloansandinterest receivablebalanceduringtheperiod. Weoffer access to merchant finance products for certain small and medium-sized businesses, which we refer to as our merchant finance offerings. Total merchant loans, advances, and interest and fees receivable outstanding, net of participation interest sold, as of December 31, 2022 was $2.1 billion compared to $1.4 billion as of December 31, 2021, representing a year-over-year increase of 48%. The increase in merchant loans, advances and interest and fees receivable outstandingwasdueprimarilytogrowthinourPayPalBusinessLoanproductsintheU.S.Approximately86%and5%ofour merchantreceivablesoutstanding as of December 31, 2022 were due from merchants in the U.S. and U.K., as compared to approximately82%and8%asofDecember31,2021,respectively. 38 •2022AnnualReport

2023 Annual Report Page 185 Page 187

2023 Annual Report Page 185 Page 187