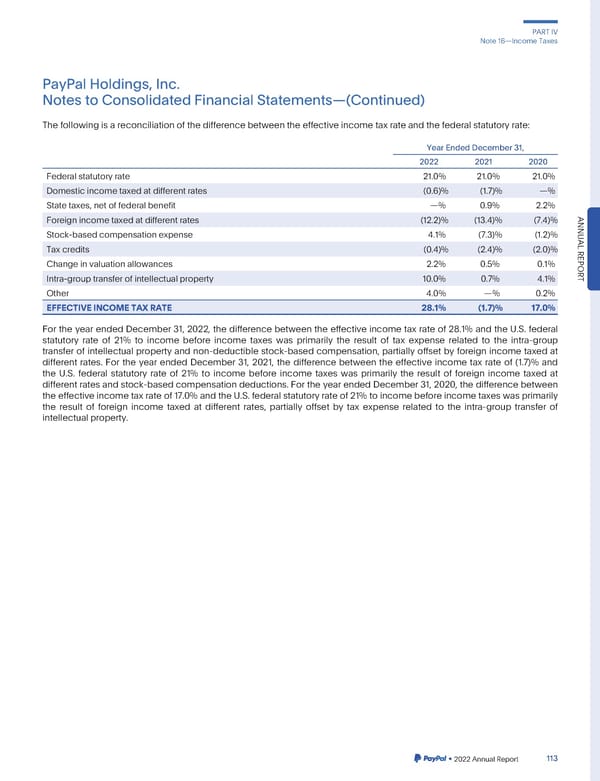

PARTIV Note16—IncomeTaxes PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) Thefollowingisareconciliationof thedifferencebetweentheeffectiveincometaxrateandthefederalstatutoryrate: YearEndedDecember31, 2022 2021 2020 Federalstatutoryrate 21.0% 21.0% 21.0% Domesticincometaxedatdifferentrates (0.6)% (1.7)% —% State taxes, net of federal benefit —% 0.9% 2.2% Foreignincometaxedatdifferentrates (12.2)% (13.4)% (7.4)% ANNU Stock-basedcompensationexpense 4.1% (7.3)% (1.2)% AL Taxcredits (0.4)% (2.4)% (2.0)% REPOR Changeinvaluationallowances 2.2% 0.5% 0.1% Intra-group transfer of intellectual property 10.0% 0.7% 4.1% T Other 4.0% —% 0.2% EFFECTIVEINCOMETAXRATE 28.1% (1.7)% 17.0% For the year ended December 31, 2022, the difference between the effective income tax rate of 28.1% and the U.S. federal statutory rate of 21% to income before income taxes was primarily the result of tax expense related to the intra-group transfer of intellectual property and non-deductible stock-based compensation, partially offset by foreign income taxed at different rates. For the year ended December 31, 2021, the difference between the effective income tax rate of (1.7)% and the U.S. federal statutory rate of 21% to income before income taxes was primarily the result of foreign income taxed at different rates and stock-based compensation deductions. For the year ended December 31, 2020, the difference between the effective income tax rate of 17.0% and the U.S. federal statutory rate of 21% to income before income taxes was primarily the result of foreign income taxed at different rates, partially offset by tax expense related to the intra-group transfer of intellectual property. •2022AnnualReport 113

2023 Annual Report Page 260 Page 262

2023 Annual Report Page 260 Page 262