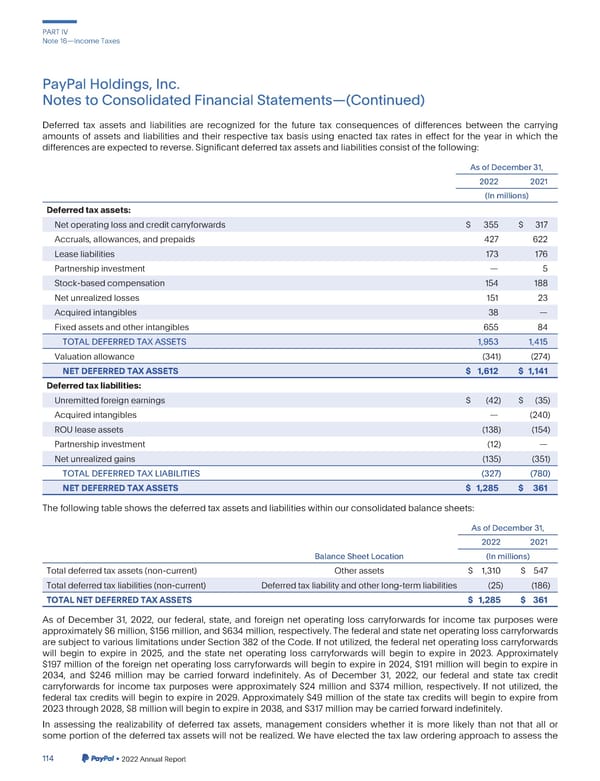

PARTIV Note16—IncomeTaxes PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) Deferred tax assets and liabilities are recognized for the future tax consequences of differences between the carrying amounts of assets and liabilities and their respective tax basis using enacted tax rates in effect for the year in which the differencesareexpectedtoreverse.Significantdeferredtaxassetsandliabilitiesconsistof thefollowing: AsofDecember31, 2022 2021 (In millions) Deferredtaxassets: Netoperatinglossandcreditcarryforwards $ 355 $ 317 Accruals,allowances,andprepaids 427 622 Leaseliabilities 173 176 Partnershipinvestment —5 Stock-basedcompensation 154 188 Netunrealizedlosses 151 23 Acquiredintangibles 38 — Fixedassetsandotherintangibles 655 84 TOTALDEFERREDTAXASSETS 1,953 1,415 Valuationallowance (341) (274) NETDEFERREDTAXASSETS $ 1,612 $ 1,141 Deferredtaxliabilities: Unremittedforeignearnings $ (42) $ (35) Acquiredintangibles — (240) ROUleaseassets (138) (154) Partnershipinvestment (12) — Netunrealizedgains (135) (351) TOTALDEFERREDTAXLIABILITIES (327) (780) NETDEFERREDTAXASSETS $ 1,285 $ 361 Thefollowingtableshowsthedeferredtaxassetsandliabilitieswithinourconsolidatedbalancesheets: AsofDecember31, 2022 2021 BalanceSheetLocation (In millions) Total deferredtax assets(non-current) Otherassets $ 1,310 $ 547 Total deferredtax liabilities (non-current) Deferredtaxliability and other long-term liabilities (25) (186) TOTALNETDEFERREDTAXASSETS $ 1,285 $ 361 As of December 31, 2022, our federal, state, and foreign net operating loss carryforwards for income tax purposes were approximately$6million,$156million,and$634million,respectively.Thefederalandstatenetoperatinglosscarryforwards are subject to various limitations under Section 382 of the Code. If not utilized, the federal net operating loss carryforwards will begin to expire in 2025, and the state net operating loss carryforwards will begin to expire in 2023. Approximately $197 million of the foreign net operating loss carryforwards will begin to expire in 2024, $191 million will begin to expire in 2034, and $246 million may be carried forward indefinitely. As of December 31, 2022, our federal and state tax credit carryforwards for income tax purposes were approximately $24 million and $374 million, respectively. If not utilized, the federal tax credits will begin to expire in 2029. Approximately $49 million of the state tax credits will begin to expire from 2023through2028,$8millionwillbegintoexpirein2038,and$317millionmaybecarriedforwardindefinitely. In assessing the realizability of deferred tax assets, management considers whether it is more likely than not that all or someportion of the deferred tax assets will not be realized. We have elected the tax law ordering approach to assess the 114 •2022AnnualReport

2023 Annual Report Page 261 Page 263

2023 Annual Report Page 261 Page 263