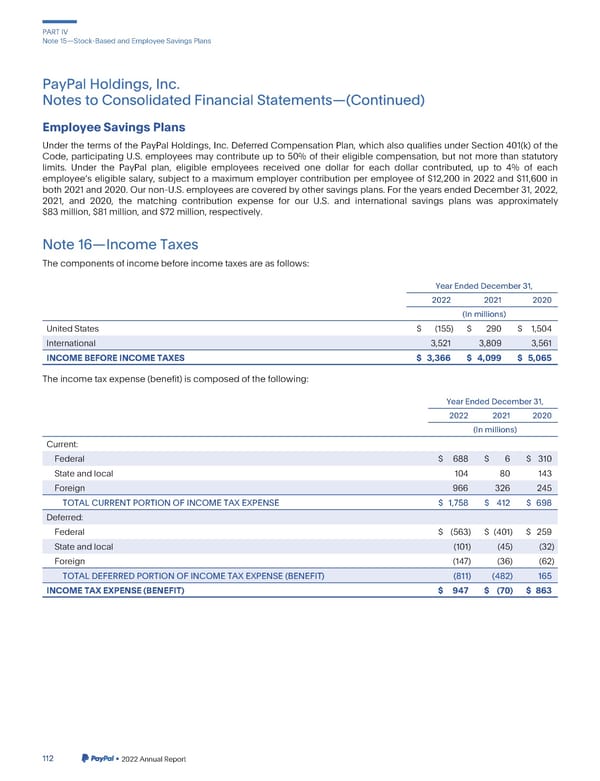

PARTIV Note15—Stock-BasedandEmployeeSavingsPlans PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) EmployeeSavingsPlans Under the terms of the PayPal Holdings, Inc. Deferred Compensation Plan, which also qualifies under Section 401(k) of the Code, participating U.S. employees may contribute up to 50% of their eligible compensation, but not more than statutory limits. Under the PayPal plan, eligible employees received one dollar for each dollar contributed, up to 4% of each employees eligible salary, subject to a maximum employer contribution per employee of $12,200 in 2022 and $11,600 in both 2021 and 2020. Our non-U.S. employees are covered by other savings plans. For the years ended December 31, 2022, 2021, and 2020, the matching contribution expense for our U.S. and international savings plans was approximately $83million, $81 million, and $72 million, respectively. Note16—IncomeTaxes Thecomponentsofincomebeforeincometaxesareasfollows: YearEndedDecember31, 2022 2021 2020 (In millions) UnitedStates $ (155) $ 290 $ 1,504 International 3,521 3,809 3,561 INCOMEBEFOREINCOMETAXES $ 3,366 $ 4,099 $ 5,065 Theincometaxexpense(benefit)iscomposedofthefollowing: YearEndedDecember31, 2022 2021 2020 (In millions) Current: Federal $ 688 $ 6 $ 310 State and local 104 80 143 Foreign 966 326 245 TOTALCURRENTPORTIONOFINCOMETAXEXPENSE $ 1,758 $ 412 $ 698 Deferred: Federal $ (563) $ (401) $ 259 State and local (101) (45) (32) Foreign (147) (36) (62) TOTALDEFERREDPORTIONOFINCOMETAXEXPENSE(BENEFIT) (811) (482) 165 INCOMETAXEXPENSE(BENEFIT) $ 947 $ (70) $ 863 112 •2022AnnualReport

2023 Annual Report Page 259 Page 261

2023 Annual Report Page 259 Page 261