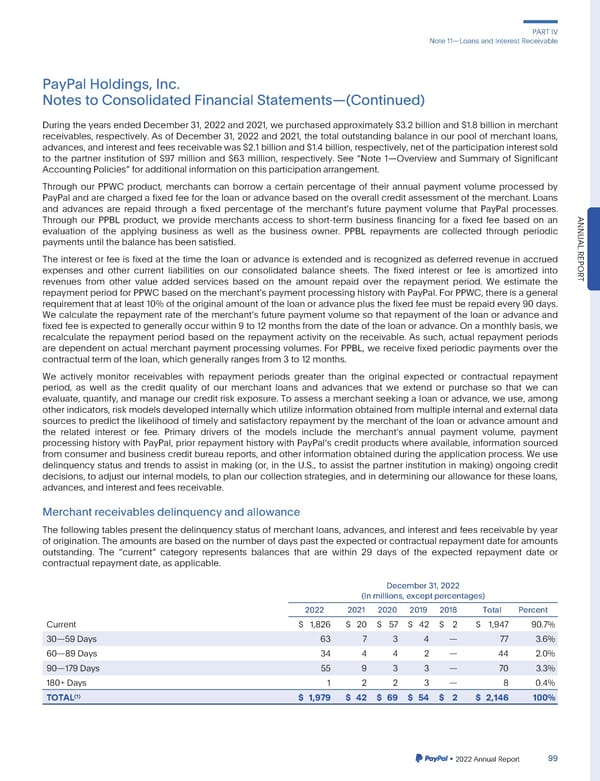

PARTIV Note11—LoansandInterestReceivable PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) During the years ended December31, 2022 and 2021, we purchasedapproximately$3.2 billion and $1.8 billion in merchant receivables, respectively. As of December 31, 2022 and 2021, the total outstanding balance in our pool of merchant loans, advances,andinterestandfeesreceivablewas$2.1billionand$1.4billion,respectively,netoftheparticipationinterestsold to the partner institution of $97 million and $63 million, respectively. See “Note 1—Overview and Summary of Significant AccountingPolicies”foradditionalinformationonthisparticipationarrangement. Through our PPWC product, merchants can borrow a certain percentage of their annual payment volume processed by PayPal and are charged a fixed fee for the loan or advance based on the overall credit assessment of the merchant. Loans and advances are repaid through a fixed percentage of the merchants future payment volume that PayPal processes. Through our PPBL product, we provide merchants access to short-term business financing for a fixed fee based on an ANNU evaluation of the applying business as well as the business owner. PPBL repayments are collected through periodic paymentsuntilthebalancehasbeensatisfied. AL The interest or fee is fixed at the time the loan or advance is extended and is recognized as deferred revenue in accrued REPOR expenses and other current liabilities on our consolidated balance sheets. The fixed interest or fee is amortized into revenues from other value added services based on the amount repaid over the repayment period. We estimate the T repaymentperiodforPPWCbasedonthemerchantspaymentprocessinghistorywithPayPal.ForPPWC,thereisageneral requirementthat at least 10% of the original amount of the loan or advance plus the fixed fee must be repaid every 90 days. Wecalculate the repayment rate of the merchants future payment volume so that repayment of the loan or advance and fixed fee is expected to generally occur within 9 to 12 months from the date of the loan or advance. On a monthly basis, we recalculate the repayment period based on the repayment activity on the receivable. As such, actual repayment periods are dependent on actual merchant payment processing volumes. For PPBL, we receive fixed periodic payments over the contractualtermoftheloan,whichgenerallyrangesfrom3to12months. We actively monitor receivables with repayment periods greater than the original expected or contractual repayment period, as well as the credit quality of our merchant loans and advances that we extend or purchase so that we can evaluate, quantify, and manage our credit risk exposure. To assess a merchant seeking a loan or advance, we use, among other indicators, risk models developedinternally which utilize information obtained from multiple internal and external data sources to predict the likelihood of timely and satisfactory repayment by the merchant of the loan or advance amount and the related interest or fee. Primary drivers of the models include the merchants annual payment volume, payment processing history with PayPal, prior repayment history with PayPals credit products where available, information sourced from consumerandbusinesscreditbureaureports,and other information obtained during the application process. We use delinquency status and trends to assist in making (or, in the U.S., to assist the partner institution in making) ongoing credit decisions, to adjust our internal models, to plan our collection strategies, and in determining our allowance for these loans, advances,andinterestandfeesreceivable. Merchantreceivablesdelinquencyandallowance The following tables present the delinquency status of merchant loans, advances, and interest and fees receivable by year of origination. The amounts are based on the number of days past the expectedor contractualrepaymentdate for amounts outstanding. The “current” category represents balances that are within 29 days of the expected repayment date or contractualrepaymentdate,asapplicable. December31,2022 (In millions, except percentages) 2022 2021 2020 2019 2018 Total Percent Current $ 1,826 $ 20 $ 57 $ 42 $ 2 $ 1,947 90.7% 30—59Days 63 7 3 4 — 77 3.6% 60—89Days 34 4 4 2 — 44 2.0% 90—179Days 55 9 3 3 — 70 3.3% 180+Days 1 2 2 3 — 8 0.4% (1) $ 1,979 $ 42 $ 69 $ 54 $ 2 $ 2,146 100% TOTAL •2022AnnualReport 99

2023 Annual Report Page 246 Page 248

2023 Annual Report Page 246 Page 248