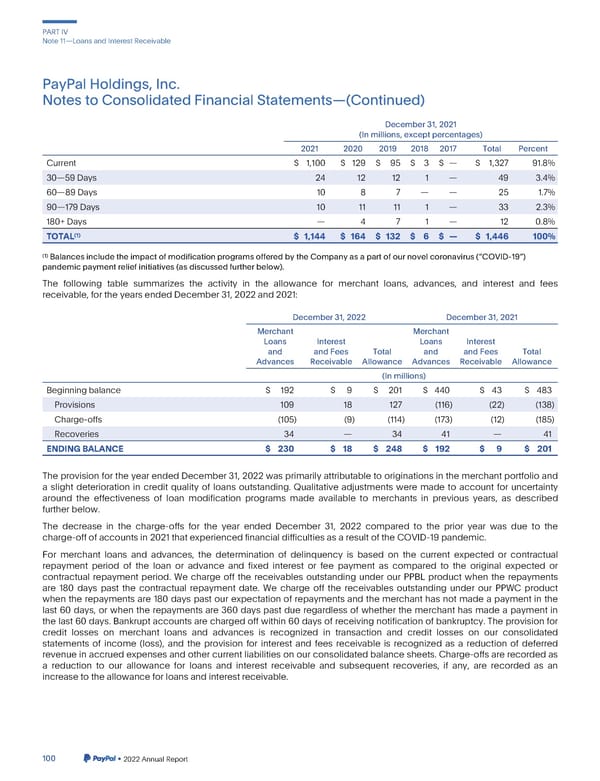

PARTIV Note11—LoansandInterestReceivable PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) December31,2021 (In millions, except percentages) 2021 2020 2019 2018 2017 Total Percent Current $ 1,100 $ 129 $ 95 $ 3 $ — $ 1,327 91.8% 30—59Days 24 12 12 1 — 49 3.4% 60—89Days 10 8 7 — — 25 1.7% 90—179Days 10 11 11 1 — 33 2.3% 180+Days — 4 7 1 — 12 0.8% (1) $ 1,144 $ 164 $ 132 $ 6 $ — $ 1,446 100% TOTAL (1) Balances include the impact of modificationprogramsofferedbytheCompanyasapartofournovelcoronavirus(“COVID-19”) pandemicpaymentreliefinitiatives(asdiscussedfurtherbelow). The following table summarizes the activity in the allowance for merchant loans, advances, and interest and fees receivable,for the years endedDecember31,2022and2021: December31,2022 December31,2021 Merchant Merchant Loans Interest Loans Interest and andFees Total and andFees Total Advances Receivable Allowance Advances Receivable Allowance (In millions) Beginningbalance $ 192 $ 9 $ 201 $ 440 $ 43 $ 483 Provisions 109 18 127 (116) (22) (138) Charge-offs (105) (9) (114) (173) (12) (185) Recoveries 34 — 34 41 — 41 ENDINGBALANCE $ 230 $ 18 $ 248 $ 192 $ 9 $ 201 Theprovision for the year ended December 31, 2022 was primarily attributable to originations in the merchant portfolio and a slight deterioration in credit quality of loans outstanding. Qualitative adjustments were made to account for uncertainty around the effectiveness of loan modification programs made available to merchants in previous years, as described further below. The decrease in the charge-offs for the year ended December 31, 2022 compared to the prior year was due to the charge-offof accountsin 2021thatexperiencedfinancialdifficultiesas a result of the COVID-19 pandemic. For merchant loans and advances, the determination of delinquency is based on the current expected or contractual repayment period of the loan or advance and fixed interest or fee payment as compared to the original expected or contractual repayment period. We charge off the receivables outstanding under our PPBL product when the repayments are 180 days past the contractual repayment date. We charge off the receivables outstanding under our PPWC product whenthe repayments are 180 days past our expectation of repayments and the merchant has not made a payment in the last 60 days, or when the repayments are 360 days past due regardless of whether the merchant has made a payment in the last 60 days. Bankrupt accounts are charged off within 60 days of receiving notification of bankruptcy. The provision for credit losses on merchant loans and advances is recognized in transaction and credit losses on our consolidated statements of income (loss), and the provision for interest and fees receivable is recognized as a reduction of deferred revenuein accruedexpensesandothercurrentliabilities on our consolidatedbalance sheets. Charge-offs are recordedas a reduction to our allowance for loans and interest receivable and subsequent recoveries, if any, are recorded as an increasetotheallowanceforloansandinterestreceivable. 100 •2022AnnualReport

2023 Annual Report Page 247 Page 249

2023 Annual Report Page 247 Page 249