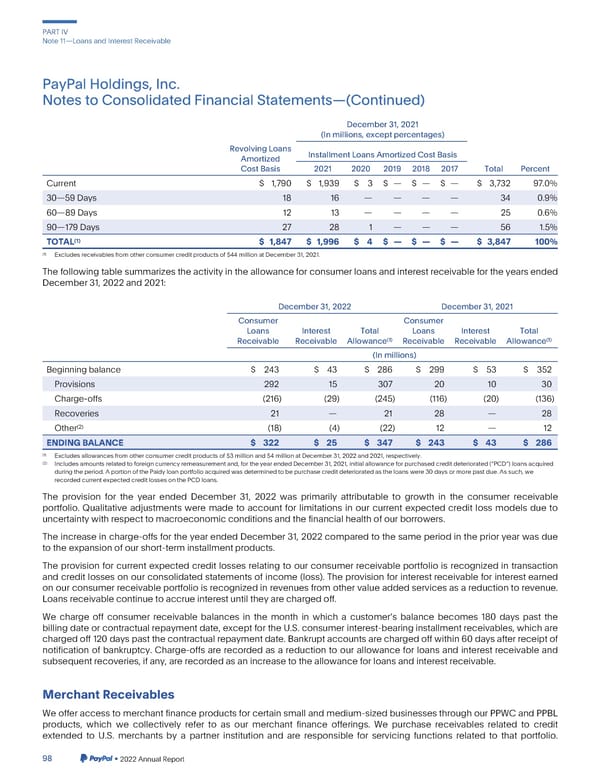

PARTIV Note11—LoansandInterestReceivable PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) December31,2021 (In millions, except percentages) RevolvingLoans InstallmentLoansAmortizedCostBasis Amortized CostBasis 2021 2020 2019 2018 2017 Total Percent Current $ 1,790 $ 1,939 $ 3 $ — $ — $ — $ 3,732 97.0% 30—59Days 18 16 — — — — 34 0.9% 60—89Days 12 13 — — — — 25 0.6% 90—179Days 27 28 1 — — — 56 1.5% (1) $ 1,847 $ 1,996 $ 4 $ — $ — $ — $ 3,847 100% TOTAL (1) Excludesreceivablesfromotherconsumercreditproductsof$44millionatDecember31,2021. Thefollowingtablesummarizestheactivityintheallowanceforconsumerloansandinterestreceivablefortheyearsended December31,2022and2021: December31,2022 December31,2021 Consumer Consumer Loans Interest Total Loans Interest Total (1) (1) Receivable Receivable Allowance Receivable Receivable Allowance (In millions) Beginningbalance $ 243 $ 43 $ 286 $ 299 $ 53 $ 352 Provisions 292 15 307 20 10 30 Charge-offs (216) (29) (245) (116) (20) (136) Recoveries 21 — 21 28 — 28 (2) (18) (4) (22) 12 — 12 Other ENDINGBALANCE $ 322 $ 25 $ 347 $ 243 $ 43 $ 286 (1) Excludesallowancesfromotherconsumercreditproductsof$3millionand$4millionatDecember31,2022and2021,respectively. (2) Includesamountsrelatedtoforeigncurrencyremeasurementand,fortheyearendedDecember31,2021,initialallowanceforpurchasedcreditdeteriorated(“PCD”)loansacquired duringtheperiod.AportionofthePaidyloanportfolioacquiredwasdeterminedtobepurchasecreditdeterioratedastheloanswere30daysormorepastdue.Assuch,we recordedcurrentexpectedcreditlossesonthePCDloans. The provision for the year ended December 31, 2022 was primarily attributable to growth in the consumer receivable portfolio. Qualitative adjustments were made to account for limitations in our current expected credit loss models due to uncertaintywith respectto macroeconomicconditionsandthefinancialhealthofourborrowers. The increase in charge-offs for the year ended December 31, 2022 compared to the same period in the prior year was due to the expansionof our short-terminstallmentproducts. The provision for current expected credit losses relating to our consumer receivable portfolio is recognized in transaction and credit losses on our consolidated statements of income (loss). The provision for interest receivable for interest earned onourconsumerreceivableportfoliois recognizedin revenuesfrom othervalueaddedservicesasareductiontorevenue. Loansreceivablecontinuetoaccrueinterestuntiltheyarechargedoff. We charge off consumer receivable balances in the month in which a customers balance becomes 180 days past the billing date or contractual repayment date, except for the U.S. consumer interest-bearinginstallment receivables,which are chargedoff120dayspastthecontractualrepaymentdate.Bankruptaccountsarechargedoffwithin60daysafterreceiptof notification of bankruptcy. Charge-offs are recorded as a reduction to our allowance for loans and interest receivable and subsequentrecoveries,if any,arerecordedasanincreasetotheallowanceforloansandinterestreceivable. MerchantReceivables Weofferaccesstomerchantfinanceproductsforcertainsmallandmedium-sizedbusinessesthroughourPPWCandPPBL products, which we collectively refer to as our merchant finance offerings. We purchase receivables related to credit extended to U.S. merchants by a partner institution and are responsible for servicing functions related to that portfolio. 98 •2022AnnualReport

2023 Annual Report Page 245 Page 247

2023 Annual Report Page 245 Page 247