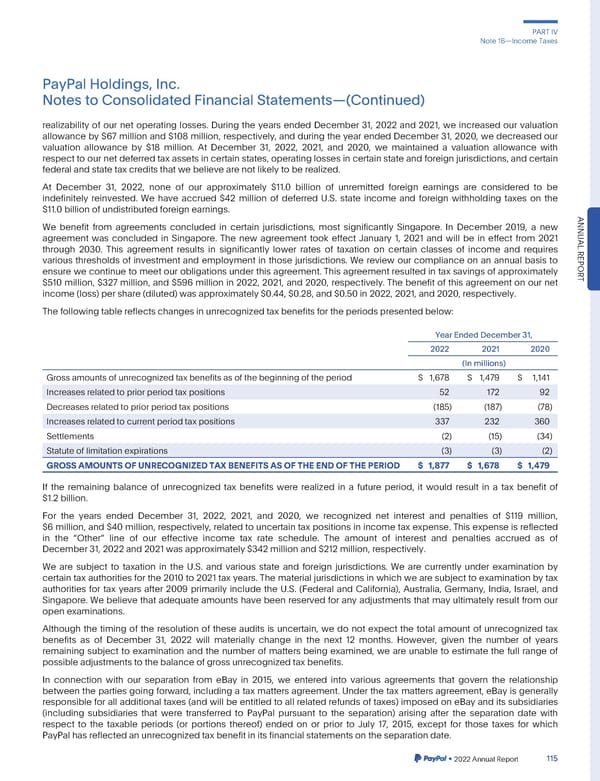

PARTIV Note16—IncomeTaxes PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) realizability of our net operating losses. During the years ended December 31, 2022 and 2021, we increased our valuation allowance by $67 million and $108 million, respectively, and during the year ended December 31, 2020, we decreased our valuation allowance by $18 million. At December 31, 2022, 2021, and 2020, we maintained a valuation allowance with respectto our net deferred tax assets in certain states, operating losses in certain state and foreign jurisdictions, and certain federal and state tax credits that we believe are not likely to be realized. At December 31, 2022, none of our approximately $11.0 billion of unremitted foreign earnings are considered to be indefinitely reinvested. We have accrued $42 million of deferred U.S. state income and foreign withholding taxes on the $11.0 billion of undistributed foreign earnings. We benefit from agreements concluded in certain jurisdictions, most significantly Singapore. In December 2019, a new ANNU agreement was concluded in Singapore. The new agreement took effect January 1, 2021 and will be in effect from 2021 AL through 2030. This agreement results in significantly lower rates of taxation on certain classes of income and requires REPOR various thresholds of investment and employment in those jurisdictions. We review our compliance on an annual basis to ensure we continue to meet our obligations under this agreement. This agreement resulted in tax savings of approximately $510 million, $327 million, and $596 million in 2022, 2021, and 2020, respectively. The benefit of this agreement on our net T income(loss)pershare(diluted)wasapproximately$0.44,$0.28,and$0.50in2022,2021,and2020,respectively. Thefollowingtablereflectschangesinunrecognizedtaxbenefitsfortheperiodspresentedbelow: YearEndedDecember31, 2022 2021 2020 (In millions) Grossamountsofunrecognizedtaxbenefitsasofthebeginningoftheperiod $ 1,678 $ 1,479 $ 1,141 Increasesrelatedtopriorperiodtaxpositions 52 172 92 Decreasesrelatedtopriorperiodtaxpositions (185) (187) (78) Increasesrelatedtocurrentperiodtaxpositions 337 232 360 Settlements (2) (15) (34) Statute of limitation expirations (3) (3) (2) GROSSAMOUNTSOFUNRECOGNIZEDTAXBENEFITSASOFTHEENDOFTHEPERIOD $ 1,877 $ 1,678 $ 1,479 If the remaining balance of unrecognized tax benefits were realized in a future period, it would result in a tax benefit of $1.2 billion. For the years ended December 31, 2022, 2021, and 2020, we recognized net interest and penalties of $119 million, $6million, and $40 million, respectively, related to uncertain tax positions in income tax expense. This expense is reflected in the “Other” line of our effective income tax rate schedule. The amount of interest and penalties accrued as of December31,2022and2021wasapproximately$342millionand$212million,respectively. We are subject to taxation in the U.S. and various state and foreign jurisdictions. We are currently under examination by certain tax authorities for the 2010 to 2021 tax years. The material jurisdictions in which we are subject to examination by tax authorities for tax years after 2009 primarily include the U.S. (Federal and California), Australia, Germany, India, Israel, and Singapore. We believe that adequate amounts have been reserved for any adjustments that may ultimately result from our openexaminations. Although the timing of the resolution of these audits is uncertain, we do not expect the total amount of unrecognized tax benefits as of December 31, 2022 will materially change in the next 12 months. However, given the number of years remaining subject to examination and the number of matters being examined, we are unable to estimate the full range of possibleadjustmentstothebalanceofgrossunrecognizedtaxbenefits. In connection with our separation from eBay in 2015, we entered into various agreements that govern the relationship betweenthe parties going forward, including a tax matters agreement. Under the tax matters agreement, eBay is generally responsible for all additional taxes (and will be entitled to all related refunds of taxes) imposed on eBay and its subsidiaries (including subsidiaries that were transferred to PayPal pursuant to the separation) arising after the separation date with respect to the taxable periods (or portions thereof) ended on or prior to July 17, 2015, except for those taxes for which PayPalhasreflectedanunrecognizedtaxbenefitinitsfinancialstatementsontheseparationdate. •2022AnnualReport 115

2023 Annual Report Page 262 Page 264

2023 Annual Report Page 262 Page 264