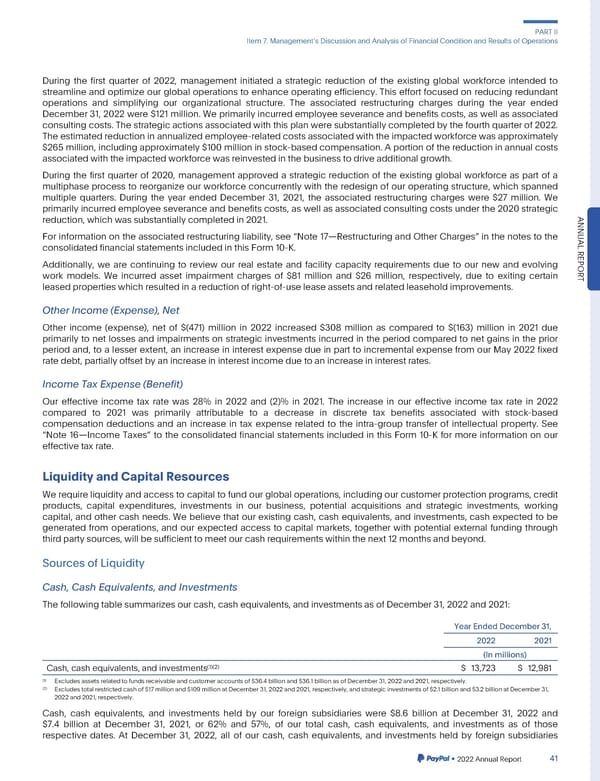

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations During the first quarter of 2022, management initiated a strategic reduction of the existing global workforce intended to streamline and optimize our global operations to enhance operating efficiency. This effort focused on reducing redundant operations and simplifying our organizational structure. The associated restructuring charges during the year ended December31,2022were$121million.Weprimarilyincurredemployeeseveranceandbenefitscosts,aswellasassociated consulting costs. The strategic actions associated with this plan were substantially completed by the fourth quarter of 2022. Theestimatedreductioninannualizedemployee-relatedcostsassociatedwiththeimpactedworkforcewasapproximately $265million, including approximately $100 million in stock-based compensation. A portion of the reduction in annual costs associatedwiththeimpactedworkforcewasreinvestedinthebusinesstodriveadditionalgrowth. During the first quarter of 2020, management approved a strategic reduction of the existing global workforce as part of a multiphase process to reorganize our workforce concurrently with the redesign of our operating structure, which spanned multiple quarters. During the year ended December 31, 2021, the associated restructuring charges were $27 million. We primarily incurred employee severance and benefits costs, as well as associated consulting costs under the 2020 strategic reduction,whichwassubstantiallycompletedin2021. ANNU For information on the associated restructuring liability, see “Note 17—Restructuring and Other Charges” in the notes to the AL consolidatedfinancialstatementsincludedinthisForm10-K. REPOR Additionally, we are continuing to review our real estate and facility capacity requirements due to our new and evolving work models. We incurred asset impairment charges of $81 million and $26 million, respectively, due to exiting certain T leasedpropertieswhichresultedinareductionofright-of-useleaseassetsandrelatedleaseholdimprovements. OtherIncome(Expense),Net Other income (expense), net of $(471) million in 2022 increased $308 million as compared to $(163) million in 2021 due primarily to net losses and impairments on strategic investments incurred in the period compared to net gains in the prior period and, to a lesser extent, an increase in interest expense due in part to incremental expense from our May 2022 fixed rate debt, partially offset by an increase in interest income due to an increase in interest rates. IncomeTaxExpense(Benefit) Our effective income tax rate was 28% in 2022 and (2)% in 2021. The increase in our effective income tax rate in 2022 compared to 2021 was primarily attributable to a decrease in discrete tax benefits associated with stock-based compensation deductions and an increase in tax expense related to the intra-group transfer of intellectual property. See “Note 16—Income Taxes” to the consolidated financial statements included in this Form 10-K for more information on our effective tax rate. LiquidityandCapitalResources Werequireliquidity and accessto capital to fund our global operations, including our customer protection programs, credit products, capital expenditures, investments in our business, potential acquisitions and strategic investments, working capital, and other cash needs. We believe that our existing cash, cash equivalents, and investments, cash expected to be generated from operations, and our expected access to capital markets, together with potential external funding through third party sources, will be sufficient to meet our cash requirementswithin the next 12 months and beyond. SourcesofLiquidity Cash,CashEquivalents,andInvestments Thefollowingtablesummarizesourcash,cashequivalents,andinvestmentsasofDecember31,2022and2021: YearEndedDecember31, 2022 2021 (In millions) (1)(2) Cash,cashequivalents,andinvestments $ 13,723 $ 12,981 (1) Excludesassetsrelatedtofundsreceivableandcustomeraccountsof$36.4billionand$36.1billionasofDecember31,2022and2021,respectively. (2) Excludestotalrestrictedcashof$17millionand$109millionatDecember31,2022and2021,respectively,andstrategicinvestmentsof$2.1billionand$3.2billionatDecember31, 2022and2021,respectively. Cash, cash equivalents, and investments held by our foreign subsidiaries were $8.6 billion at December 31, 2022 and $7.4 billion at December 31, 2021, or 62% and 57%, of our total cash, cash equivalents, and investments as of those respective dates. At December 31, 2022, all of our cash, cash equivalents, and investments held by foreign subsidiaries •2022AnnualReport 41

2023 Annual Report Page 188 Page 190

2023 Annual Report Page 188 Page 190