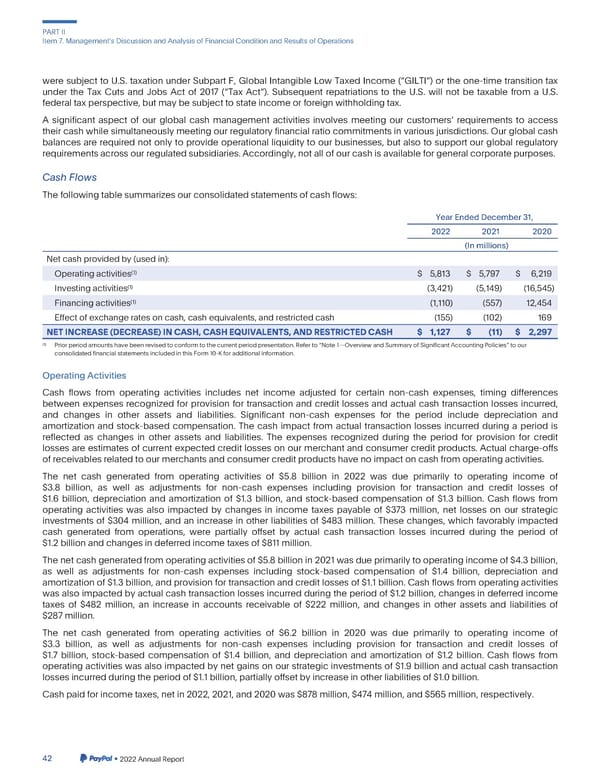

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations were subject to U.S. taxation under Subpart F, Global Intangible Low Taxed Income (“GILTI”) or the one-time transition tax under the Tax Cuts and Jobs Act of 2017 (“Tax Act”). Subsequent repatriations to the U.S. will not be taxable from a U.S. federal tax perspective,but may be subjectto state income or foreign withholdingtax. A significant aspect of our global cash management activities involves meeting our customers requirements to access their cash while simultaneously meeting our regulatory financial ratio commitments in various jurisdictions. Our global cash balances are required not only to provide operational liquidity to our businesses, but also to support our global regulatory requirementsacrossourregulatedsubsidiaries.Accordingly,notallofourcashisavailableforgeneralcorporatepurposes. CashFlows Thefollowingtablesummarizesourconsolidatedstatementsofcashflows: YearEndedDecember31, 2022 2021 2020 (In millions) Netcashprovidedby(usedin): (1) Operatingactivities $ 5,813 $ 5,797 $ 6,219 (1) Investingactivities (3,421) (5,149) (16,545) (1) Financingactivities (1,110) (557) 12,454 Effect of exchangeratesoncash,cashequivalents,andrestrictedcash (155) (102) 169 NETINCREASE(DECREASE)INCASH,CASHEQUIVALENTS,ANDRESTRICTEDCASH $ 1,127 $ (11) $ 2,297 (1) Prior period amountshavebeenrevisedtoconformtothecurrentperiodpresentation.Referto“Note1—OverviewandSummaryofSignificantAccountingPolicies”toour consolidatedfinancialstatementsincludedinthisForm10-Kforadditionalinformation. OperatingActivities Cash flows from operating activities includes net income adjusted for certain non-cash expenses, timing differences between expenses recognized for provision for transaction and credit losses and actual cash transaction losses incurred, and changes in other assets and liabilities. Significant non-cash expenses for the period include depreciation and amortization and stock-based compensation. The cash impact from actual transaction losses incurred during a period is reflected as changes in other assets and liabilities. The expenses recognized during the period for provision for credit losses are estimates of current expected credit losses on our merchant and consumer credit products. Actual charge-offs of receivablesrelatedto our merchantsandconsumercreditproductshavenoimpactoncashfromoperatingactivities. The net cash generated from operating activities of $5.8 billion in 2022 was due primarily to operating income of $3.8 billion, as well as adjustments for non-cash expenses including provision for transaction and credit losses of $1.6 billion, depreciation and amortization of $1.3 billion, and stock-based compensation of $1.3 billion. Cash flows from operating activities was also impacted by changes in income taxes payable of $373 million, net losses on our strategic investments of $304 million, and an increase in other liabilities of $483 million. These changes, which favorably impacted cash generated from operations, were partially offset by actual cash transaction losses incurred during the period of $1.2 billion and changes in deferred income taxes of $811 million. Thenetcashgeneratedfromoperatingactivitiesof$5.8billionin2021wasdueprimarilytooperatingincomeof$4.3billion, as well as adjustments for non-cash expenses including stock-based compensation of $1.4 billion, depreciation and amortization of $1.3 billion, and provision for transaction and credit losses of $1.1 billion. Cash flows from operating activities wasalsoimpactedbyactualcashtransactionlosses incurredduring the period of $1.2 billion, changes in deferred income taxes of $482 million, an increase in accounts receivable of $222 million, and changes in other assets and liabilities of $287million. The net cash generated from operating activities of $6.2 billion in 2020 was due primarily to operating income of $3.3 billion, as well as adjustments for non-cash expenses including provision for transaction and credit losses of $1.7 billion, stock-based compensation of $1.4 billion, and depreciation and amortization of $1.2 billion. Cash flows from operating activities was also impacted by net gains on our strategic investments of $1.9 billion and actual cash transaction lossesincurredduringtheperiodof$1.1billion,partiallyoffset by increasein other liabilitiesof $1.0 billion. Cashpaidforincometaxes,netin2022,2021,and2020was$878million,$474million,and$565million,respectively. 42 •2022AnnualReport

2023 Annual Report Page 189 Page 191

2023 Annual Report Page 189 Page 191