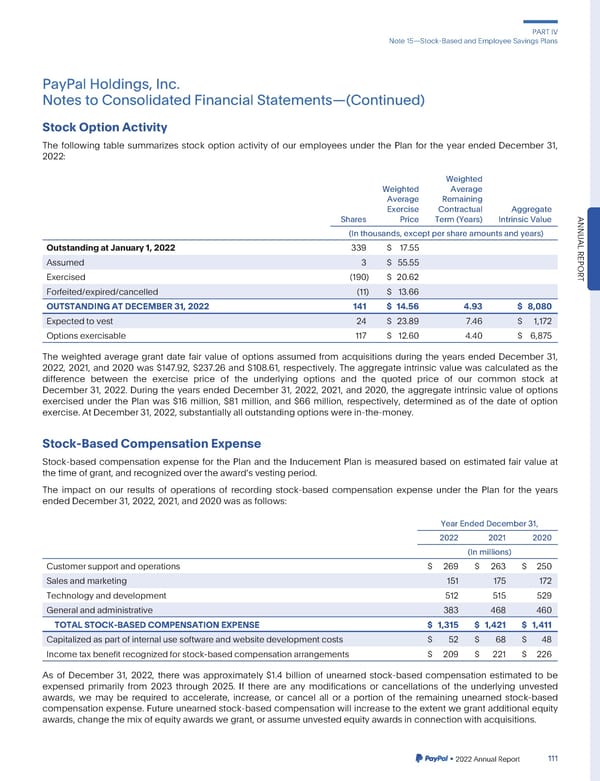

PARTIV Note15—Stock-BasedandEmployeeSavingsPlans PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) StockOptionActivity The following table summarizes stock option activity of our employees under the Plan for the year ended December 31, 2022: Weighted Weighted Average Average Remaining Exercise Contractual Aggregate Shares Price Term(Years) Intrinsic Value ANNU (In thousands,exceptpershareamountsandyears) AL OutstandingatJanuary1,2022 339 $ 17.55 REPOR Assumed 3 $ 55.55 Exercised (190) $ 20.62 T Forfeited/expired/cancelled (11) $ 13.66 OUTSTANDINGATDECEMBER31,2022 141 $ 14.56 4.93 $ 8,080 Expectedtovest 24 $ 23.89 7.46 $ 1,172 Optionsexercisable 117 $ 12.60 4.40 $ 6,875 The weighted average grant date fair value of options assumed from acquisitions during the years ended December 31, 2022, 2021, and 2020 was $147.92, $237.26 and $108.61, respectively. The aggregate intrinsic value was calculated as the difference between the exercise price of the underlying options and the quoted price of our common stock at December 31, 2022. During the years ended December 31, 2022, 2021, and 2020, the aggregate intrinsic value of options exercised under the Plan was $16 million, $81 million, and $66 million, respectively, determined as of the date of option exercise.At December31,2022,substantiallyall outstandingoptionswerein-the-money. Stock-BasedCompensationExpense Stock-based compensation expense for the Plan and the Inducement Plan is measured based on estimated fair value at thetimeofgrant,andrecognizedovertheawardsvestingperiod. The impact on our results of operations of recording stock-based compensation expense under the Plan for the years endedDecember31,2022,2021,and2020wasasfollows: YearEndedDecember31, 2022 2021 2020 (In millions) Customersupportandoperations $ 269 $ 263 $ 250 Salesandmarketing 151 175 172 Technologyanddevelopment 512 515 529 Generalandadministrative 383 468 460 TOTALSTOCK-BASEDCOMPENSATIONEXPENSE $ 1,315 $ 1,421 $ 1,411 Capitalized as part of internal use software and website developmentcosts $ 52 $ 68 $ 48 Incometaxbenefitrecognizedforstock-basedcompensationarrangements $ 209 $ 221 $ 226 As of December 31, 2022, there was approximately $1.4 billion of unearned stock-based compensation estimated to be expensed primarily from 2023 through 2025. If there are any modifications or cancellations of the underlying unvested awards, we may be required to accelerate, increase, or cancel all or a portion of the remaining unearned stock-based compensationexpense.Future unearned stock-based compensationwill increase to the extent we grant additional equity awards,changethemixofequityawardswegrant,orassumeunvestedequityawardsinconnectionwithacquisitions. •2022AnnualReport 111

2023 Annual Report Page 258 Page 260

2023 Annual Report Page 258 Page 260