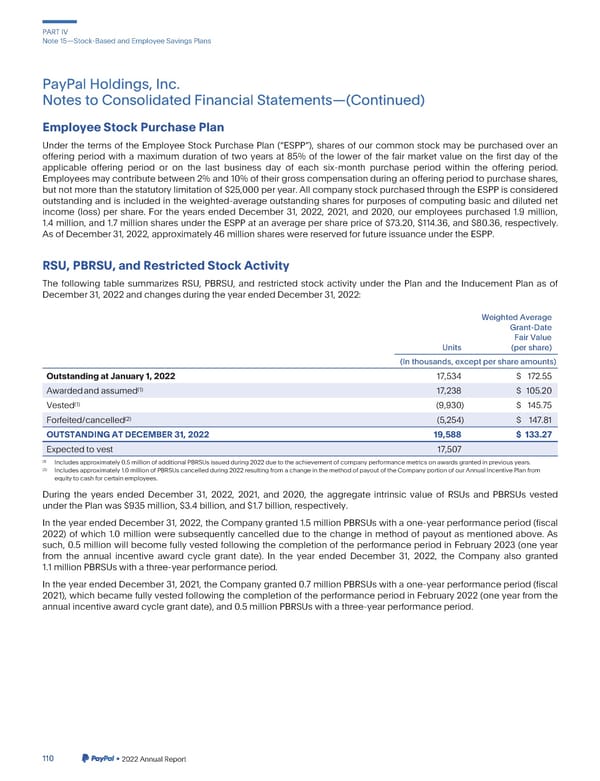

PARTIV Note15—Stock-BasedandEmployeeSavingsPlans PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) EmployeeStockPurchasePlan Under the terms of the Employee Stock Purchase Plan (“ESPP”), shares of our common stock may be purchased over an offering period with a maximum duration of two years at 85% of the lower of the fair market value on the first day of the applicable offering period or on the last business day of each six-month purchase period within the offering period. Employeesmaycontributebetween2%and10%oftheirgrosscompensationduringanofferingperiodtopurchaseshares, but not more than the statutory limitation of $25,000 per year. All company stock purchasedthrough the ESPP is considered outstanding and is included in the weighted-average outstanding shares for purposes of computing basic and diluted net income (loss) per share. For the years ended December 31, 2022, 2021, and 2020, our employees purchased 1.9 million, 1.4 million, and 1.7 million shares under the ESPP at an average per share price of $73.20, $114.36, and $80.36, respectively. AsofDecember31,2022,approximately46millionshareswerereservedforfutureissuanceundertheESPP. RSU,PBRSU,andRestrictedStockActivity The following table summarizes RSU, PBRSU, and restricted stock activity under the Plan and the Inducement Plan as of December31,2022andchangesduringtheyearendedDecember31,2022: WeightedAverage Grant-Date Fair Value Units (per share) (In thousands,exceptpershareamounts) OutstandingatJanuary1,2022 17,534 $ 172.55 (1) Awardedandassumed 17,238 $ 105.20 (1) Vested (9,930) $ 145.75 (2) Forfeited/cancelled (5,254) $ 147.81 OUTSTANDINGATDECEMBER31,2022 19,588 $ 133.27 Expectedtovest 17,507 (1) Includesapproximately0.5millionofadditionalPBRSUsissuedduring2022duetotheachievementofcompanyperformancemetricsonawardsgrantedinpreviousyears. (2) Includesapproximately1.0millionofPBRSUscancelledduring2022resultingfromachangeinthemethodofpayoutoftheCompanyportionofourAnnualIncentivePlanfrom equitytocashforcertainemployees. During the years ended December 31, 2022, 2021, and 2020, the aggregate intrinsic value of RSUs and PBRSUs vested underthePlanwas$935million,$3.4billion,and$1.7billion,respectively. In the year ended December31, 2022, the Company granted1.5 million PBRSUs with a one-year performanceperiod (fiscal 2022) of which 1.0 million were subsequently cancelled due to the change in method of payout as mentioned above. As such, 0.5 million will become fully vested following the completion of the performance period in February 2023 (one year from the annual incentive award cycle grant date). In the year ended December 31, 2022, the Company also granted 1.1 million PBRSUs with a three-year performanceperiod. In the year ended December31, 2021, the Company granted 0.7 million PBRSUs with a one-year performanceperiod (fiscal 2021), which became fully vested following the completion of the performance period in February 2022 (one year from the annualincentiveawardcyclegrantdate),and0.5millionPBRSUswithathree-yearperformanceperiod. 110 •2022AnnualReport

2023 Annual Report Page 257 Page 259

2023 Annual Report Page 257 Page 259