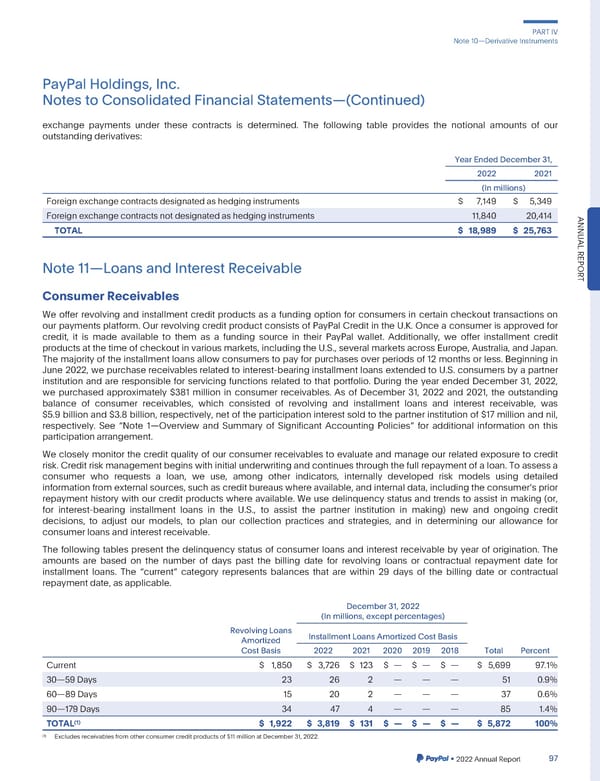

PARTIV Note10—DerivativeInstruments PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) exchange payments under these contracts is determined. The following table provides the notional amounts of our outstandingderivatives: YearEndedDecember31, 2022 2021 (In millions) Foreignexchangecontractsdesignatedashedginginstruments $ 7,149 $ 5,349 Foreignexchangecontractsnotdesignatedashedginginstruments 11,840 20,414 ANNU TOTAL $ 18,989 $ 25,763 AL REPOR Note11—LoansandInterestReceivable T ConsumerReceivables Weoffer revolving and installment credit products as a funding option for consumers in certain checkout transactions on our payments platform. Our revolving credit product consists of PayPal Credit in the U.K. Once a consumer is approved for credit, it is made available to them as a funding source in their PayPal wallet. Additionally, we offer installment credit productsatthetimeofcheckoutinvariousmarkets,includingtheU.S.,severalmarketsacrossEurope,Australia,andJapan. The majority of the installment loans allow consumers to pay for purchases over periods of 12 months or less. Beginning in June 2022, we purchase receivables related to interest-bearing installment loans extended to U.S. consumers by a partner institution and are responsible for servicing functions related to that portfolio. During the year ended December 31, 2022, we purchased approximately $381 million in consumer receivables. As of December 31, 2022 and 2021, the outstanding balance of consumer receivables, which consisted of revolving and installment loans and interest receivable, was $5.9 billion and $3.8 billion, respectively, net of the participation interest sold to the partner institution of $17 million and nil, respectively. See “Note 1—Overview and Summary of Significant Accounting Policies” for additional information on this participationarrangement. Weclosely monitor the credit quality of our consumer receivables to evaluate and manage our related exposure to credit risk. Credit risk management begins with initial underwriting and continues through the full repayment of a loan. To assess a consumer who requests a loan, we use, among other indicators, internally developed risk models using detailed information from external sources, such as credit bureaus where available, and internal data, including the consumers prior repayment history with our credit products where available. We use delinquency status and trends to assist in making (or, for interest-bearing installment loans in the U.S., to assist the partner institution in making) new and ongoing credit decisions, to adjust our models, to plan our collection practices and strategies, and in determining our allowance for consumerloansandinterestreceivable. The following tables present the delinquency status of consumer loans and interest receivable by year of origination. The amounts are based on the number of days past the billing date for revolving loans or contractual repayment date for installment loans. The “current” category represents balances that are within 29 days of the billing date or contractual repaymentdate,asapplicable. December31,2022 (In millions, except percentages) RevolvingLoans InstallmentLoansAmortizedCostBasis Amortized CostBasis 2022 2021 2020 2019 2018 Total Percent Current $ 1,850 $ 3,726 $ 123 $ — $ — $ — $ 5,699 97.1% 30—59Days 23 26 2 — — — 51 0.9% 60—89Days 15 20 2 — — — 37 0.6% 90—179Days 34 47 4 — — — 85 1.4% (1) $ 1,922 $ 3,819 $ 131 $ — $ — $ — $ 5,872 100% TOTAL (1) Excludesreceivablesfromotherconsumercreditproductsof$11millionatDecember31,2022. •2022AnnualReport 97

2023 Annual Report Page 244 Page 246

2023 Annual Report Page 244 Page 246