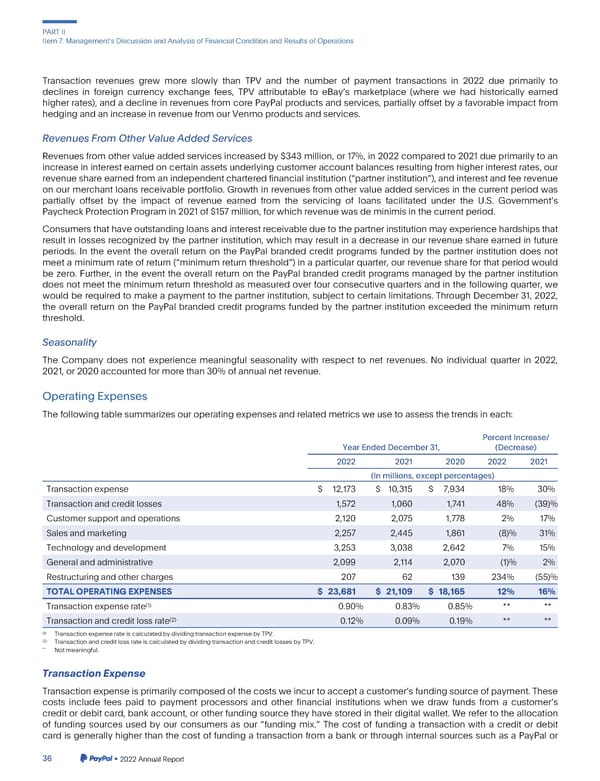

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations Transaction revenues grew more slowly than TPV and the number of payment transactions in 2022 due primarily to declines in foreign currency exchange fees, TPV attributable to eBays marketplace (where we had historically earned higher rates), and a decline in revenues from core PayPal products and services, partially offset by a favorable impact from hedgingandanincreaseinrevenuefromourVenmoproductsandservices. RevenuesFromOtherValueAddedServices Revenuesfromothervalueaddedservicesincreasedby$343million,or17%,in2022comparedto2021dueprimarilytoan increase in interest earned on certain assets underlying customer account balances resulting from higher interest rates, our revenueshareearnedfromanindependentcharteredfinancialinstitution(“partnerinstitution”),andinterestandfeerevenue on our merchant loans receivable portfolio. Growth in revenues from other value added services in the current period was partially offset by the impact of revenue earned from the servicing of loans facilitated under the U.S. Governments PaycheckProtectionProgramin2021of$157million,forwhichrevenuewasdeminimisinthecurrentperiod. Consumersthathaveoutstandingloansandinterestreceivableduetothepartnerinstitutionmayexperiencehardshipsthat result in losses recognized by the partner institution, which may result in a decrease in our revenue share earned in future periods. In the event the overall return on the PayPal branded credit programs funded by the partner institution does not meetaminimumrateofreturn(“minimumreturnthreshold”)in a particularquarter, our revenue share for that period would be zero. Further, in the event the overall return on the PayPal branded credit programs managed by the partner institution does not meet the minimum return threshold as measured over four consecutive quarters and in the following quarter, we would be required to make a payment to the partner institution, subject to certain limitations. Through December 31, 2022, the overall return on the PayPal branded credit programs funded by the partner institution exceeded the minimum return threshold. Seasonality The Company does not experience meaningful seasonality with respect to net revenues. No individual quarter in 2022, 2021, or 2020 accountedfor morethan30%ofannualnetrevenue. OperatingExpenses Thefollowingtablesummarizesouroperatingexpensesandrelatedmetricsweusetoassessthetrendsineach: PercentIncrease/ YearEndedDecember31, (Decrease) 2022 2021 2020 2022 2021 (In millions, except percentages) Transactionexpense $ 12,173 $ 10,315 $ 7,934 18% 30% Transactionandcreditlosses 1,572 1,060 1,741 48% (39)% Customersupportandoperations 2,120 2,075 1,778 2% 17% Salesandmarketing 2,257 2,445 1,861 (8)% 31% Technologyanddevelopment 3,253 3,038 2,642 7% 15% Generalandadministrative 2,099 2,114 2,070 (1)% 2% Restructuringandothercharges 207 62 139 234% (55)% TOTALOPERATINGEXPENSES $ 23,681 $ 21,109 $ 18,165 12% 16% (1) 0.90% 0.83% 0.85% ** ** Transactionexpenserate (2) Transactionandcreditlossrate 0.12% 0.09% 0.19% ** ** (1) TransactionexpenserateiscalculatedbydividingtransactionexpensebyTPV. (2) TransactionandcreditlossrateiscalculatedbydividingtransactionandcreditlossesbyTPV. ** Notmeaningful. TransactionExpense Transactionexpenseisprimarilycomposedofthecostsweincurtoacceptacustomersfundingsourceofpayment.These costs include fees paid to payment processors and other financial institutions when we draw funds from a customers credit or debit card, bank account, or other funding source they have stored in their digital wallet. We refer to the allocation of funding sources used by our consumers as our “funding mix.” The cost of funding a transaction with a credit or debit card is generally higher than the cost of funding a transaction from a bank or through internal sources such as a PayPal or 36 •2022AnnualReport

2023 Annual Report Page 183 Page 185

2023 Annual Report Page 183 Page 185