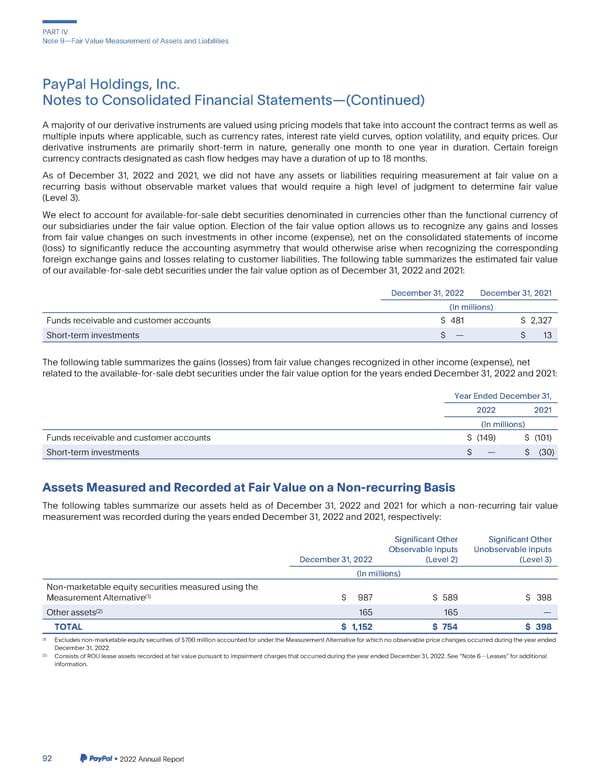

PARTIV Note9—FairValueMeasurementofAssetsandLiabilities PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) Amajorityof our derivativeinstrumentsare valued using pricing models that take into account the contractterms as well as multiple inputs where applicable, such as currency rates, interest rate yield curves, option volatility, and equity prices. Our derivative instruments are primarily short-term in nature, generally one month to one year in duration. Certain foreign currencycontractsdesignatedascashflowhedgesmayhaveadurationofupto18months. As of December 31, 2022 and 2021, we did not have any assets or liabilities requiring measurement at fair value on a recurring basis without observable market values that would require a high level of judgment to determine fair value (Level 3). Weelect to account for available-for-sale debt securities denominated in currencies other than the functional currency of our subsidiaries under the fair value option. Election of the fair value option allows us to recognize any gains and losses from fair value changes on such investments in other income (expense), net on the consolidated statements of income (loss) to significantly reduce the accounting asymmetry that would otherwise arise when recognizing the corresponding foreign exchange gains and losses relating to customer liabilities. The following table summarizes the estimated fair value of our available-for-saledebt securities under the fair value option as of December 31, 2022 and 2021: December31,2022 December31,2021 (In millions) Fundsreceivableandcustomeraccounts $ 481 $ 2,327 Short-terminvestments $— $ 13 Thefollowingtablesummarizesthegains(losses)fromfairvaluechangesrecognizedinotherincome(expense),net related to the available-for-saledebt securities under the fair value option for the years ended December 31, 2022 and 2021: YearEndedDecember31, 2022 2021 (In millions) Fundsreceivableandcustomeraccounts $ (149) $ (101) Short-terminvestments $ — $ (30) AssetsMeasuredandRecordedatFairValueonaNon-recurringBasis The following tables summarize our assets held as of December 31, 2022 and 2021 for which a non-recurring fair value measurementwasrecordedduringtheyearsendedDecember31,2022and2021,respectively: SignificantOther SignificantOther ObservableInputs UnobservableInputs December31,2022 (Level 2) (Level 3) (In millions) Non-marketableequitysecuritiesmeasuredusingthe (1) MeasurementAlternative $ 987 $ 589 $ 398 (2) Otherassets 165 165 — TOTAL $ 1,152 $ 754 $ 398 (1) Excludesnon-marketableequitysecuritiesof$700millionaccountedforundertheMeasurementAlternativeforwhichnoobservablepricechangesoccurredduringtheyearended December31,2022. (2) ConsistsofROUleaseassetsrecordedatfairvaluepursuanttoimpairmentchargesthatoccurredduringtheyearendedDecember31,2022.See“Note6—Leases”foradditional information. 92 •2022AnnualReport

2023 Annual Report Page 239 Page 241

2023 Annual Report Page 239 Page 241