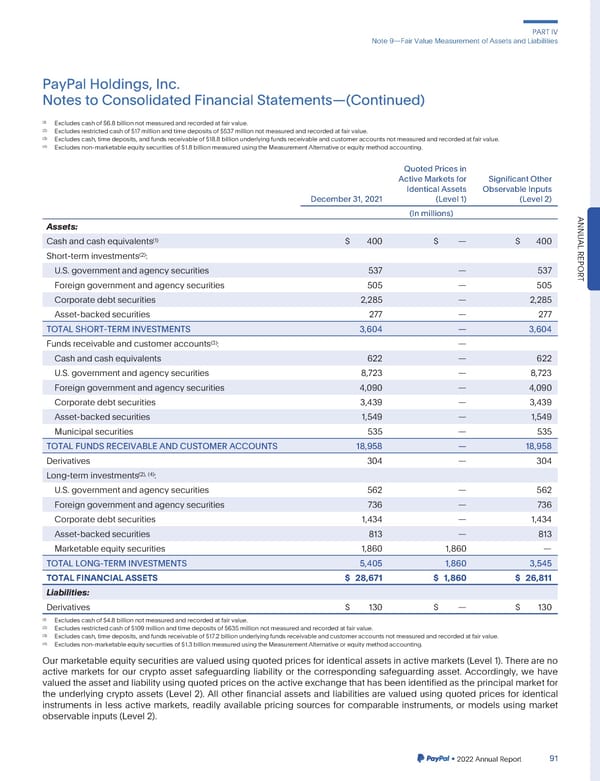

PARTIV Note9—FairValueMeasurementofAssetsandLiabilities PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) (1) Excludescashof$6.8billionnotmeasuredandrecordedatfairvalue. (2) Excludesrestrictedcashof$17millionandtimedepositsof$537millionnotmeasuredandrecordedatfairvalue. (3) Excludescash,timedeposits,andfundsreceivableof$18.8billionunderlyingfundsreceivableandcustomeraccountsnotmeasuredandrecordedatfairvalue. (4) Excludesnon-marketableequitysecuritiesof$1.8billionmeasuredusingtheMeasurementAlternativeorequitymethodaccounting. QuotedPricesin ActiveMarketsfor SignificantOther Identical Assets ObservableInputs December31,2021 (Level 1) (Level 2) (In millions) Assets: ANNU (1) AL Cashandcashequivalents $ 400 $ — $ 400 (2) REPOR Short-terminvestments : U.S. governmentandagencysecurities 537 — 537 Foreigngovernmentandagencysecurities 505 — 505 T Corporatedebtsecurities 2,285 — 2,285 Asset-backedsecurities 277 — 277 TOTALSHORT-TERMINVESTMENTS 3,604 — 3,604 (3) Fundsreceivableandcustomeraccounts :— Cashandcashequivalents 622 — 622 U.S. governmentandagencysecurities 8,723 — 8,723 Foreigngovernmentandagencysecurities 4,090 — 4,090 Corporatedebtsecurities 3,439 — 3,439 Asset-backedsecurities 1,549 — 1,549 Municipalsecurities 535 — 535 TOTALFUNDSRECEIVABLEANDCUSTOMERACCOUNTS 18,958 — 18,958 Derivatives 304 — 304 (2), (4) Long-terminvestments : U.S. governmentandagencysecurities 562 — 562 Foreigngovernmentandagencysecurities 736 — 736 Corporatedebtsecurities 1,434 — 1,434 Asset-backedsecurities 813 — 813 Marketableequitysecurities 1,860 1,860 — TOTALLONG-TERMINVESTMENTS 5,405 1,860 3,545 TOTALFINANCIALASSETS $ 28,671 $ 1,860 $ 26,811 Liabilities: Derivatives $ 130 $ — $ 130 (1) Excludescashof$4.8billionnotmeasuredandrecordedatfairvalue. (2) Excludesrestrictedcashof$109millionandtimedepositsof$635millionnotmeasuredandrecordedatfairvalue. (3) Excludescash,timedeposits,andfundsreceivableof$17.2billionunderlyingfundsreceivableandcustomeraccountsnotmeasuredandrecordedatfairvalue. (4) Excludesnon-marketableequitysecuritiesof$1.3billionmeasuredusingtheMeasurementAlternativeorequitymethodaccounting. Ourmarketableequitysecuritiesare valued using quoted prices for identicalassets in active markets (Level 1). There are no active markets for our crypto asset safeguarding liability or the corresponding safeguarding asset. Accordingly, we have valuedtheassetandliabilityusingquotedpricesontheactiveexchangethathasbeenidentifiedastheprincipalmarketfor the underlying crypto assets (Level 2). All other financial assets and liabilities are valued using quoted prices for identical instruments in less active markets, readily available pricing sources for comparable instruments, or models using market observableinputs(Level2). •2022AnnualReport 91

2023 Annual Report Page 238 Page 240

2023 Annual Report Page 238 Page 240