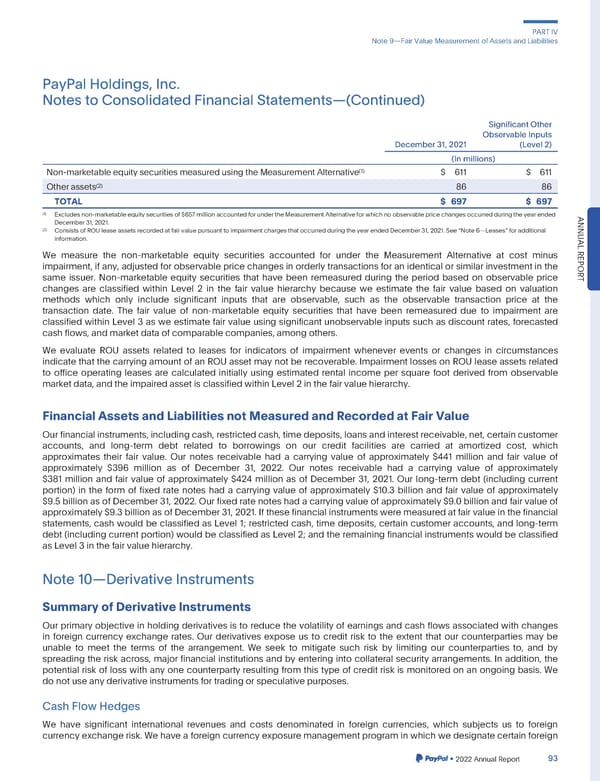

PARTIV Note9—FairValueMeasurementofAssetsandLiabilities PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) SignificantOther ObservableInputs December31,2021 (Level 2) (In millions) (1) Non-marketableequitysecuritiesmeasuredusingtheMeasurementAlternative $ 611 $ 611 (2) Otherassets 86 86 TOTAL $ 697 $ 697 (1) Excludesnon-marketableequitysecuritiesof$657millionaccountedforundertheMeasurementAlternativeforwhichnoobservablepricechangesoccurredduringtheyearended December31,2021. ANNU (2) ConsistsofROUleaseassetsrecordedatfairvaluepursuanttoimpairmentchargesthatoccurredduringtheyearendedDecember31,2021.See“Note6—Leases”foradditional information. AL We measure the non-marketable equity securities accounted for under the Measurement Alternative at cost minus REPOR impairment,if any, adjusted for observable price changes in orderly transactions for an identical or similar investment in the same issuer. Non-marketable equity securities that have been remeasured during the period based on observable price T changes are classified within Level 2 in the fair value hierarchy because we estimate the fair value based on valuation methods which only include significant inputs that are observable, such as the observable transaction price at the transaction date. The fair value of non-marketable equity securities that have been remeasured due to impairment are classified within Level 3 as we estimate fair value using significant unobservable inputs such as discount rates, forecasted cashflows,andmarketdataofcomparablecompanies,amongothers. We evaluate ROU assets related to leases for indicators of impairment whenever events or changes in circumstances indicate that the carrying amount of an ROU asset may not be recoverable. Impairment losses on ROU lease assets related to office operating leases are calculated initially using estimated rental income per square foot derived from observable marketdata,andtheimpairedassetisclassifiedwithinLevel2inthefairvaluehierarchy. FinancialAssetsandLiabilitiesnotMeasuredandRecordedatFairValue Ourfinancialinstruments,includingcash,restrictedcash,timedeposits,loansandinterestreceivable,net,certaincustomer accounts, and long-term debt related to borrowings on our credit facilities are carried at amortized cost, which approximates their fair value. Our notes receivable had a carrying value of approximately $441 million and fair value of approximately $396 million as of December 31, 2022. Our notes receivable had a carrying value of approximately $381 million and fair value of approximately $424 million as of December 31, 2021. Our long-term debt (including current portion) in the form of fixed rate notes had a carrying value of approximately $10.3 billion and fair value of approximately $9.5 billion as of December 31, 2022. Our fixed rate notes had a carrying value of approximately $9.0 billion and fair value of approximately$9.3billion as of December31, 2021. If these financial instrumentswere measuredat fair value in the financial statements, cash would be classified as Level 1; restricted cash, time deposits, certain customer accounts, and long-term debt (including current portion) would be classified as Level 2; and the remaining financial instruments would be classified asLevel3inthefairvaluehierarchy. Note10—DerivativeInstruments SummaryofDerivativeInstruments Our primary objective in holding derivatives is to reduce the volatility of earnings and cash flows associated with changes in foreign currency exchange rates. Our derivatives expose us to credit risk to the extent that our counterparties may be unable to meet the terms of the arrangement. We seek to mitigate such risk by limiting our counterparties to, and by spreading the risk across, major financial institutions and by entering into collateral security arrangements. In addition, the potential risk of loss with any one counterparty resulting from this type of credit risk is monitored on an ongoing basis. We donotuseanyderivativeinstrumentsfortradingorspeculativepurposes. CashFlowHedges We have significant international revenues and costs denominated in foreign currencies, which subjects us to foreign currencyexchangerisk.Wehaveaforeigncurrencyexposuremanagementprograminwhichwedesignatecertainforeign •2022AnnualReport 93

2023 Annual Report Page 240 Page 242

2023 Annual Report Page 240 Page 242