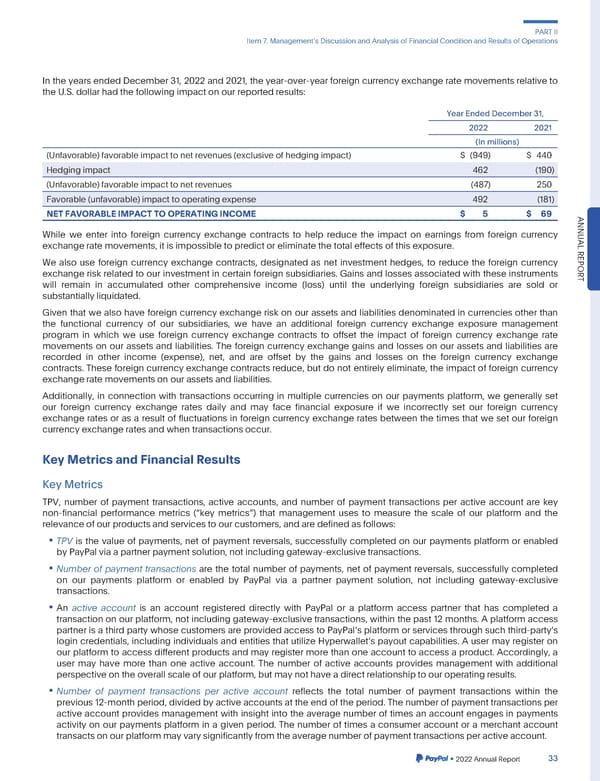

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations In the years ended December31, 2022 and 2021, the year-over-yearforeign currency exchangerate movementsrelativeto theU.S.dollarhadthefollowingimpactonourreportedresults: YearEndedDecember31, 2022 2021 (In millions) (Unfavorable)favorableimpacttonetrevenues(exclusiveofhedgingimpact) $ (949) $ 440 Hedgingimpact 462 (190) (Unfavorable)favorableimpacttonetrevenues (487) 250 Favorable(unfavorable)impacttooperatingexpense 492 (181) NETFAVORABLEIMPACTTOOPERATINGINCOME $ 5 $ 69 ANNU While we enter into foreign currency exchange contracts to help reduce the impact on earnings from foreign currency exchangeratemovements,itisimpossibletopredictoreliminatethetotaleffectsofthisexposure. AL Wealso use foreign currency exchange contracts, designated as net investment hedges, to reduce the foreign currency REPOR exchangerisk related to our investment in certain foreign subsidiaries. Gains and losses associated with these instruments will remain in accumulated other comprehensive income (loss) until the underlying foreign subsidiaries are sold or T substantially liquidated. Given that we also have foreign currency exchange risk on our assets and liabilities denominated in currencies other than the functional currency of our subsidiaries, we have an additional foreign currency exchange exposure management program in which we use foreign currency exchange contracts to offset the impact of foreign currency exchange rate movements on our assets and liabilities. The foreign currency exchange gains and losses on our assets and liabilities are recorded in other income (expense), net, and are offset by the gains and losses on the foreign currency exchange contracts. These foreign currency exchange contracts reduce, but do not entirely eliminate, the impact of foreign currency exchangeratemovementsonourassetsandliabilities. Additionally, in connection with transactions occurring in multiple currencies on our payments platform, we generally set our foreign currency exchange rates daily and may face financial exposure if we incorrectly set our foreign currency exchange rates or as a result of fluctuations in foreign currency exchange rates between the times that we set our foreign currencyexchangeratesandwhentransactionsoccur. KeyMetricsandFinancialResults KeyMetrics TPV, number of payment transactions, active accounts, and number of payment transactions per active account are key non-financial performance metrics (“key metrics”) that management uses to measure the scale of our platform and the relevanceofourproductsandservicestoourcustomers,andaredefinedasfollows: • TPV is the value of payments, net of payment reversals, successfully completed on our payments platform or enabled byPayPalviaapartnerpaymentsolution,notincludinggateway-exclusivetransactions. • Number of payment transactions are the total number of payments, net of payment reversals, successfully completed on our payments platform or enabled by PayPal via a partner payment solution, not including gateway-exclusive transactions. • An active account is an account registered directly with PayPal or a platform access partner that has completed a transaction on our platform, not including gateway-exclusive transactions, within the past 12 months. A platform access partner is a third party whose customers are provided access to PayPals platform or services through such third-partys login credentials, including individuals and entities that utilize Hyperwallets payout capabilities. A user may register on our platform to access different products and may register more than one account to access a product. Accordingly, a user may have more than one active account. The number of active accounts provides management with additional perspectiveontheoverallscaleofourplatform,butmaynothaveadirectrelationshiptoouroperatingresults. • Number of payment transactions per active account reflects the total number of payment transactions within the previous 12-month period, divided by active accounts at the end of the period. The number of payment transactionsper active account provides management with insight into the average number of times an account engages in payments activity on our payments platform in a given period. The number of times a consumer account or a merchant account transactsonourplatformmayvarysignificantlyfromtheaveragenumberofpaymenttransactionsperactiveaccount. •2022AnnualReport 33

2023 Annual Report Page 180 Page 182

2023 Annual Report Page 180 Page 182