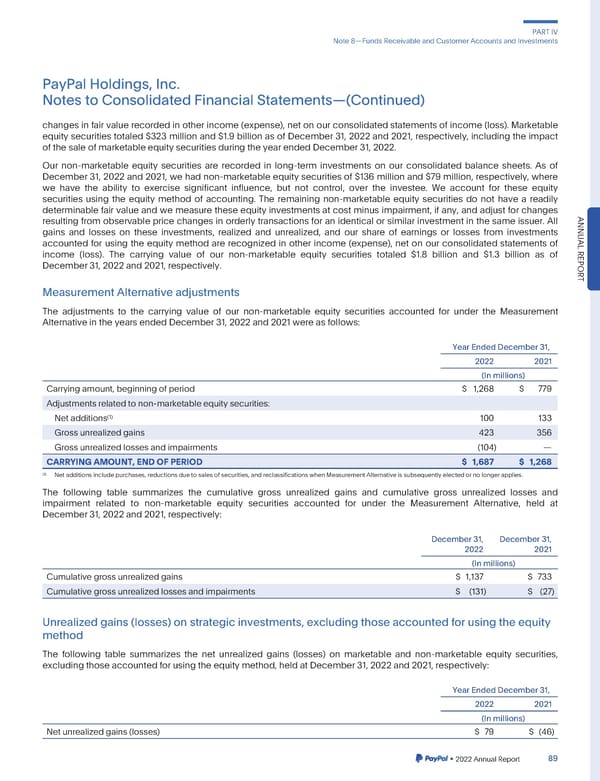

PARTIV Note8—FundsReceivableandCustomerAccountsandInvestments PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) changesinfair value recordedin other income (expense), net on our consolidated statements of income (loss). Marketable equity securities totaled $323 million and $1.9 billion as of December 31, 2022 and 2021, respectively, including the impact of the sale of marketableequity securitiesduring the year ended December31, 2022. Our non-marketable equity securities are recorded in long-term investments on our consolidated balance sheets. As of December31,2022and2021,wehadnon-marketableequitysecuritiesof $136 million and $79 million, respectively,where we have the ability to exercise significant influence, but not control, over the investee. We account for these equity securities using the equity method of accounting. The remaining non-marketable equity securities do not have a readily determinable fair value and we measure these equity investments at cost minus impairment, if any, and adjust for changes resulting from observable price changes in orderly transactions for an identical or similar investment in the same issuer. All ANNU gains and losses on these investments, realized and unrealized, and our share of earnings or losses from investments accounted for using the equity method are recognized in other income (expense), net on our consolidated statements of AL income (loss). The carrying value of our non-marketable equity securities totaled $1.8 billion and $1.3 billion as of REPOR December31,2022and2021,respectively. T MeasurementAlternativeadjustments The adjustments to the carrying value of our non-marketable equity securities accounted for under the Measurement Alternativein the years ended December31, 2022and2021wereasfollows: YearEndedDecember31, 2022 2021 (In millions) Carryingamount,beginningofperiod $ 1,268 $ 779 Adjustmentsrelatedtonon-marketableequitysecurities: (1) Netadditions 100 133 Grossunrealizedgains 423 356 Grossunrealizedlossesandimpairments (104) — CARRYINGAMOUNT,ENDOFPERIOD $ 1,687 $ 1,268 (1) Netadditionsincludepurchases,reductionsduetosalesofsecurities,andreclassificationswhenMeasurementAlternativeissubsequentlyelectedornolongerapplies. The following table summarizes the cumulative gross unrealized gains and cumulative gross unrealized losses and impairment related to non-marketable equity securities accounted for under the Measurement Alternative, held at December31,2022and2021,respectively: December31, December31, 2022 2021 (In millions) Cumulativegrossunrealizedgains $ 1,137 $ 733 Cumulativegrossunrealizedlossesandimpairments $ (131) $ (27) Unrealizedgains(losses)onstrategicinvestments,excludingthoseaccountedforusingtheequity method The following table summarizes the net unrealized gains (losses) on marketable and non-marketable equity securities, excludingthoseaccountedforusingtheequitymethod,heldatDecember31,2022and2021,respectively: YearEndedDecember31, 2022 2021 (In millions) Netunrealizedgains(losses) $ 79 $ (46) •2022AnnualReport 89

2023 Annual Report Page 236 Page 238

2023 Annual Report Page 236 Page 238