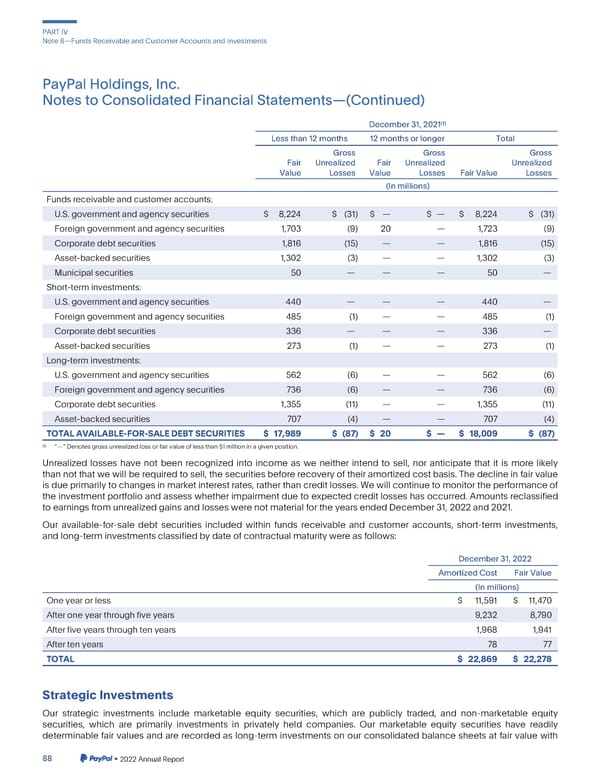

PARTIV Note8—FundsReceivableandCustomerAccountsandInvestments PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) (1) December31,2021 Lessthan12months 12 monthsorlonger Total Gross Gross Gross Fair Unrealized Fair Unrealized Unrealized Value Losses Value Losses Fair Value Losses (In millions) Fundsreceivableandcustomeraccounts: U.S. governmentandagencysecurities $ 8,224 $ (31) $ — $ — $ 8,224 $ (31) Foreigngovernmentandagencysecurities 1,703 (9) 20 — 1,723 (9) Corporatedebtsecurities 1,816 (15) — — 1,816 (15) Asset-backedsecurities 1,302 (3) — — 1,302 (3) Municipalsecurities 50 — — — 50 — Short-terminvestments: U.S. governmentandagencysecurities 440 — — — 440 — Foreigngovernmentandagencysecurities 485 (1) — — 485 (1) Corporatedebtsecurities 336 — — — 336 — Asset-backedsecurities 273 (1) — — 273 (1) Long-terminvestments: U.S. governmentandagencysecurities 562 (6) — — 562 (6) Foreigngovernmentandagencysecurities 736 (6) — — 736 (6) Corporatedebtsecurities 1,355 (11) — — 1,355 (11) Asset-backedsecurities 707 (4) — — 707 (4) TOTALAVAILABLE-FOR-SALEDEBTSECURITIES $ 17,989 $ (87) $ 20 $ — $ 18,009 $ (87) (1) “—”Denotesgrossunrealizedlossorfairvalueoflessthan$1millioninagivenposition. Unrealized losses have not been recognized into income as we neither intend to sell, nor anticipate that it is more likely than not that we will be required to sell, the securities before recovery of their amortized cost basis. The decline in fair value is due primarily to changes in market interest rates, rather than credit losses. We will continue to monitor the performanceof the investment portfolio and assess whether impairment due to expected credit losses has occurred. Amounts reclassified to earningsfromunrealizedgainsandlosseswerenotmaterialfortheyearsendedDecember31,2022and2021. Our available-for-sale debt securities included within funds receivable and customer accounts, short-term investments, andlong-terminvestmentsclassifiedbydateofcontractualmaturitywereasfollows: December31,2022 AmortizedCost Fair Value (In millions) Oneyearorless $ 11,591 $ 11,470 After one year through five years 9,232 8,790 After five years through ten years 1,968 1,941 After ten years 78 77 TOTAL $ 22,869 $ 22,278 StrategicInvestments Our strategic investments include marketable equity securities, which are publicly traded, and non-marketable equity securities, which are primarily investments in privately held companies. Our marketable equity securities have readily determinable fair values and are recorded as long-term investments on our consolidated balance sheets at fair value with 88 •2022AnnualReport

2023 Annual Report Page 235 Page 237

2023 Annual Report Page 235 Page 237