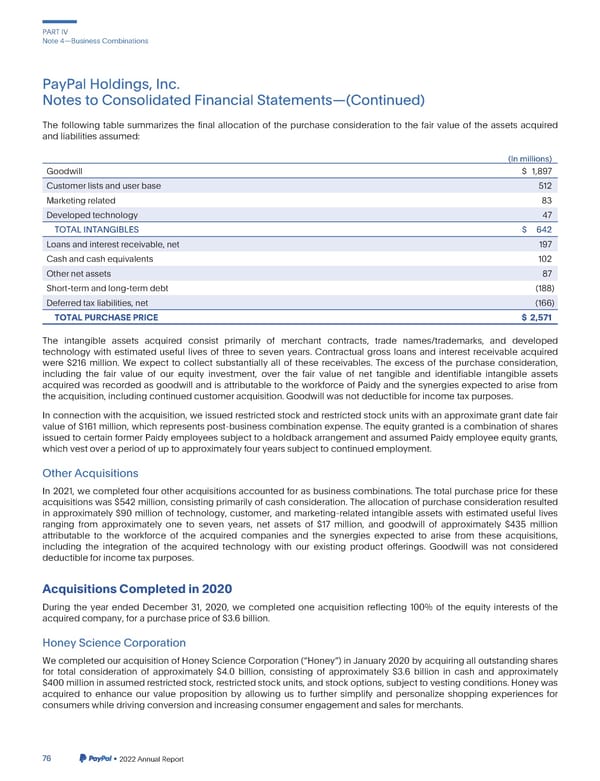

PARTIV Note4—BusinessCombinations PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) The following table summarizes the final allocation of the purchase consideration to the fair value of the assets acquired andliabilities assumed: (In millions) Goodwill $ 1,897 Customerlistsanduserbase 512 Marketingrelated 83 Developedtechnology 47 TOTALINTANGIBLES $ 642 Loansandinterestreceivable,net 197 Cashandcashequivalents 102 Othernetassets 87 Short-termandlong-termdebt (188) Deferredtaxliabilities, net (166) TOTALPURCHASEPRICE $ 2,571 The intangible assets acquired consist primarily of merchant contracts, trade names/trademarks, and developed technology with estimated useful lives of three to seven years. Contractual gross loans and interest receivable acquired were $216 million. We expect to collect substantially all of these receivables. The excess of the purchase consideration, including the fair value of our equity investment, over the fair value of net tangible and identifiable intangible assets acquired was recorded as goodwill and is attributable to the workforce of Paidy and the synergies expected to arise from theacquisition,includingcontinuedcustomeracquisition.Goodwillwasnotdeductibleforincometaxpurposes. In connection with the acquisition, we issued restricted stock and restricted stock units with an approximate grant date fair value of $161 million, which represents post-business combination expense. The equity granted is a combination of shares issued to certain former Paidy employees subject to a holdback arrangement and assumed Paidy employee equity grants, whichvestoveraperiodofuptoapproximatelyfouryearssubjecttocontinuedemployment. OtherAcquisitions In 2021, we completed four other acquisitions accounted for as business combinations. The total purchase price for these acquisitions was $542 million, consisting primarily of cash consideration. The allocation of purchase consideration resulted in approximately $90 million of technology, customer, and marketing-related intangible assets with estimated useful lives ranging from approximately one to seven years, net assets of $17 million, and goodwill of approximately $435 million attributable to the workforce of the acquired companies and the synergies expected to arise from these acquisitions, including the integration of the acquired technology with our existing product offerings. Goodwill was not considered deductiblefor incometaxpurposes. AcquisitionsCompletedin2020 During the year ended December 31, 2020, we completed one acquisition reflecting 100% of the equity interests of the acquiredcompany,forapurchasepriceof$3.6billion. HoneyScienceCorporation WecompletedouracquisitionofHoneyScienceCorporation(“Honey”)inJanuary2020byacquiringalloutstandingshares for total consideration of approximately $4.0 billion, consisting of approximately $3.6 billion in cash and approximately $400millioninassumedrestrictedstock,restrictedstockunits,andstockoptions,subjecttovestingconditions.Honeywas acquired to enhance our value proposition by allowing us to further simplify and personalize shopping experiences for consumerswhiledrivingconversionandincreasingconsumerengagementandsalesformerchants. 76 •2022AnnualReport

2023 Annual Report Page 223 Page 225

2023 Annual Report Page 223 Page 225