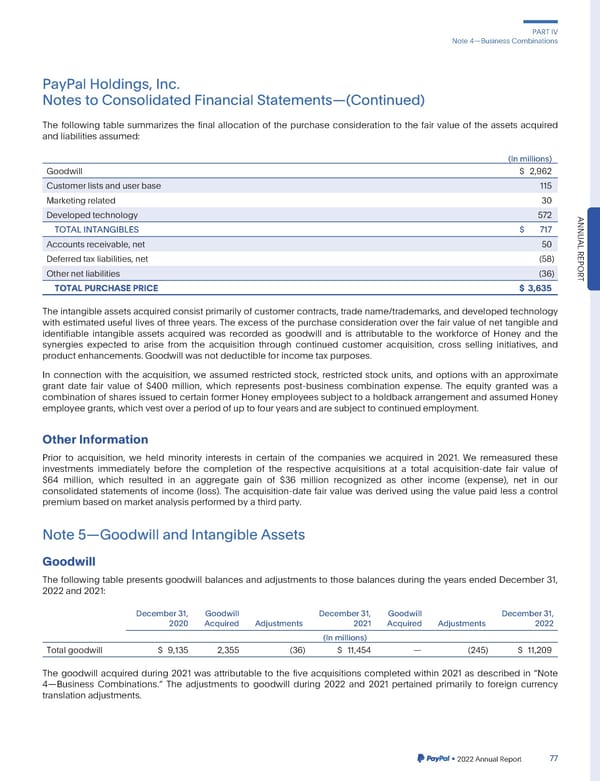

PARTIV Note4—BusinessCombinations PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) The following table summarizes the final allocation of the purchase consideration to the fair value of the assets acquired andliabilities assumed: (In millions) Goodwill $ 2,962 Customerlistsanduserbase 115 Marketingrelated 30 Developedtechnology 572 ANNU TOTALINTANGIBLES $ 717 Accountsreceivable,net 50 AL Deferredtaxliabilities, net (58) REPOR Othernetliabilities (36) TOTALPURCHASEPRICE $ 3,635 T Theintangible assets acquired consist primarily of customer contracts, trade name/trademarks,and developed technology with estimated useful lives of three years. The excess of the purchase consideration over the fair value of net tangible and identifiable intangible assets acquired was recorded as goodwill and is attributable to the workforce of Honey and the synergies expected to arise from the acquisition through continued customer acquisition, cross selling initiatives, and productenhancements.Goodwillwasnotdeductibleforincometaxpurposes. In connection with the acquisition, we assumed restricted stock, restricted stock units, and options with an approximate grant date fair value of $400 million, which represents post-business combination expense. The equity granted was a combinationof shares issued to certain former Honey employees subject to a holdback arrangement and assumed Honey employeegrants,whichvestoveraperiodofuptofouryearsandaresubjecttocontinuedemployment. OtherInformation Prior to acquisition, we held minority interests in certain of the companies we acquired in 2021. We remeasured these investments immediately before the completion of the respective acquisitions at a total acquisition-date fair value of $64 million, which resulted in an aggregate gain of $36 million recognized as other income (expense), net in our consolidated statements of income (loss). The acquisition-date fair value was derived using the value paid less a control premiumbasedonmarketanalysisperformedbyathirdparty. Note5—GoodwillandIntangibleAssets Goodwill The following table presents goodwill balances and adjustments to those balances during the years ended December 31, 2022and2021: December31, Goodwill December31, Goodwill December31, 2020 Acquired Adjustments 2021 Acquired Adjustments 2022 (In millions) Total goodwill $ 9,135 2,355 (36) $ 11,454 — (245) $ 11,209 The goodwill acquired during 2021 was attributable to the five acquisitions completed within 2021 as described in “Note 4—Business Combinations.” The adjustments to goodwill during 2022 and 2021 pertained primarily to foreign currency translation adjustments. •2022AnnualReport 77

2023 Annual Report Page 224 Page 226

2023 Annual Report Page 224 Page 226