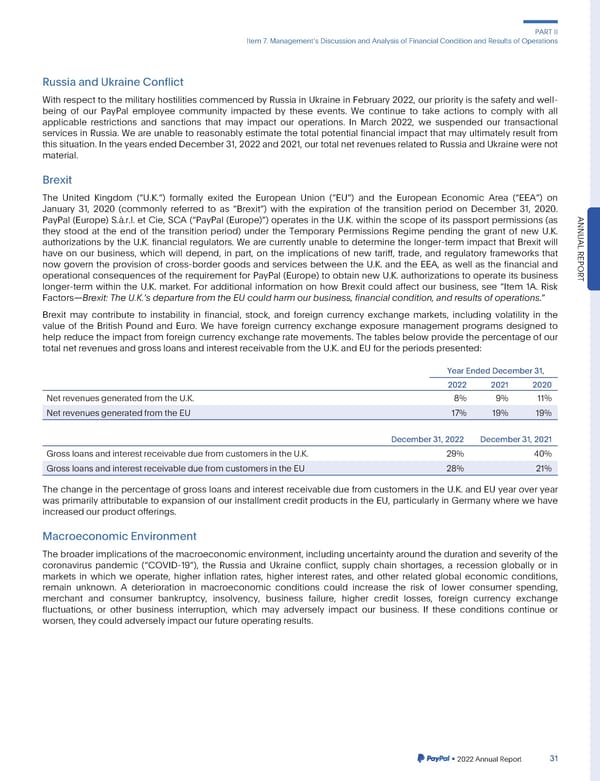

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations RussiaandUkraineConflict With respect to the military hostilities commenced by Russia in Ukraine in February 2022, our priority is the safety and well- being of our PayPal employee community impacted by these events. We continue to take actions to comply with all applicable restrictions and sanctions that may impact our operations. In March 2022, we suspended our transactional services in Russia. We are unable to reasonably estimate the total potential financial impact that may ultimately result from this situation. In the years ended December31, 2022 and 2021, our total net revenues related to Russia and Ukraine were not material. Brexit The United Kingdom (“U.K.”) formally exited the European Union (“EU”) and the European Economic Area (“EEA”) on January 31, 2020 (commonly referred to as “Brexit”) with the expiration of the transition period on December 31, 2020. PayPal (Europe) S.à.r.l. et Cie, SCA (“PayPal (Europe)”) operates in the U.K. within the scope of its passport permissions (as ANNU they stood at the end of the transition period) under the Temporary Permissions Regime pending the grant of new U.K. authorizations by the U.K. financial regulators. We are currently unable to determine the longer-term impact that Brexit will AL have on our business, which will depend, in part, on the implications of new tariff, trade, and regulatory frameworks that REPOR nowgovern the provision of cross-border goods and services between the U.K. and the EEA, as well as the financial and operational consequences of the requirement for PayPal (Europe) to obtain new U.K. authorizations to operate its business T longer-term within the U.K. market. For additional information on how Brexit could affect our business, see “Item 1A. Risk Factors—Brexit: The U.K.s departurefrom the EU could harm our business,financialcondition,and results of operations.” Brexit may contribute to instability in financial, stock, and foreign currency exchange markets, including volatility in the value of the British Pound and Euro. We have foreign currency exchange exposure management programs designed to help reduce the impact from foreign currency exchange rate movements. The tables below provide the percentage of our total net revenues and gross loans and interest receivablefrom the U.K. and EU for the periods presented: YearEndedDecember31, 2022 2021 2020 NetrevenuesgeneratedfromtheU.K. 8% 9% 11% NetrevenuesgeneratedfromtheEU 17% 19% 19% December31,2022 December31,2021 GrossloansandinterestreceivableduefromcustomersintheU.K. 29% 40% GrossloansandinterestreceivableduefromcustomersintheEU 28% 21% The changein the percentageof gross loans and interest receivable due from customers in the U.K. and EU year over year wasprimarily attributable to expansion of our installment credit products in the EU, particularly in Germany where we have increasedourproductofferings. MacroeconomicEnvironment Thebroaderimplicationsof the macroeconomicenvironment,includinguncertaintyaroundthedurationandseverityof the coronavirus pandemic (“COVID-19”), the Russia and Ukraine conflict, supply chain shortages, a recession globally or in markets in which we operate, higher inflation rates, higher interest rates, and other related global economic conditions, remain unknown. A deterioration in macroeconomic conditions could increase the risk of lower consumer spending, merchant and consumer bankruptcy, insolvency, business failure, higher credit losses, foreign currency exchange fluctuations, or other business interruption, which may adversely impact our business. If these conditions continue or worsen,theycouldadverselyimpactourfutureoperatingresults. •2022AnnualReport 31

2023 Annual Report Page 178 Page 180

2023 Annual Report Page 178 Page 180