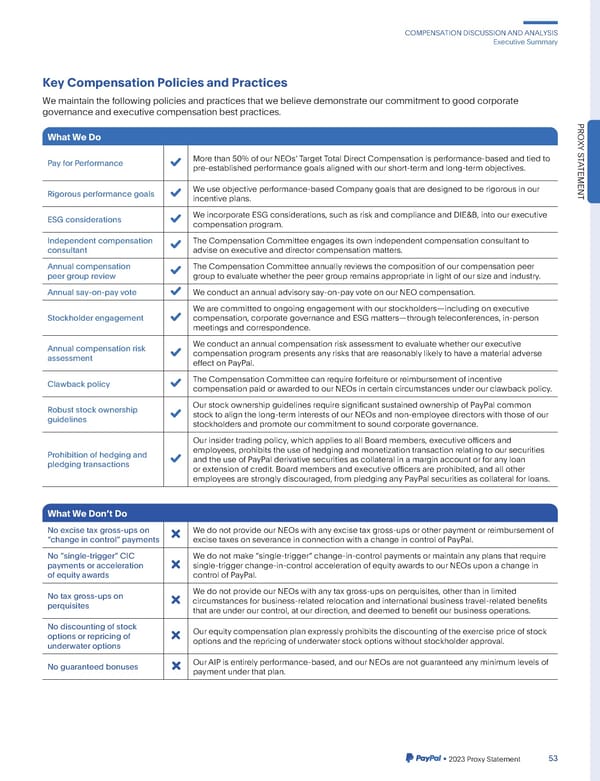

COMPENSATIONDISCUSSIONANDANALYSIS ExecutiveSummary KeyCompensationPoliciesandPractices Wemaintainthefollowingpoliciesandpracticesthatwebelievedemonstrateourcommitmenttogoodcorporate governanceandexecutivecompensationbestpractices. What We Do PRO XY S More than 50% of our NEOs Target Total Direct Compensation is performance-based and tied to T Pay for Performance A pre-established performance goals aligned with our short-term and long-term objectives. TEMENT Rigorous performance goals We use objective performance-based Company goals that are designed to be rigorous in our incentive plans. ESG considerations We incorporate ESG considerations, such as risk and compliance and DIE&B, into our executive compensation program. Independent compensation The Compensation Committee engages its own independent compensation consultant to consultant advise on executive and director compensation matters. Annual compensation The Compensation Committee annually reviews the composition of our compensation peer peer group review group to evaluate whether the peer group remains appropriate in light of our size and industry. Annual say-on-pay vote We conduct an annual advisory say-on-pay vote on our NEO compensation. We are committed to ongoing engagement with our stockholders—including on executive Stockholder engagement compensation, corporate governance and ESG matters—through teleconferences, in-person meetings and correspondence. Annual compensation risk We conduct an annual compensation risk assessment to evaluate whether our executive assessment compensation program presents any risks that are reasonably likely to have a material adverse effect on PayPal. Clawback policy The Compensation Committee can require forfeiture or reimbursement of incentive compensation paid or awarded to our NEOs in certain circumstances under our clawback policy. Robust stock ownership Our stock ownership guidelines require significant sustained ownership of PayPal common guidelines stock to align the long-term interests of our NEOs and non-employee directors with those of our stockholders and promote our commitment to sound corporate governance. Our insider trading policy, which applies to all Board members, executive officers and Prohibition of hedging and employees, prohibits the use of hedging and monetization transaction relating to our securities pledging transactions and the use of PayPal derivative securities as collateral in a margin account or for any loan or extension of credit. Board members and executive officers are prohibited, and all other employees are strongly discouraged, from pledging any PayPal securities as collateral for loans. What We Dont Do No excise tax gross-ups on We do not provide our NEOs with any excise tax gross-ups or other payment or reimbursement of “change in control” payments excise taxes on severance in connection with a change in control of PayPal. No “single-trigger” CIC We do not make “single-trigger” change-in-control payments or maintain any plans that require payments or acceleration single-trigger change-in-control acceleration of equity awards to our NEOs upon a change in of equity awards control of PayPal. No tax gross-ups on We do not provide our NEOs with any tax gross-ups on perquisites, other than in limited perquisites circumstances for business-related relocation and international business travel-related benefits that are under our control, at our direction, and deemed to benefit our business operations. No discounting of stock Our equity compensation plan expressly prohibits the discounting of the exercise price of stock options or repricing of options and the repricing of underwater stock options without stockholder approval. underwater options No guaranteed bonuses Our AIP is entirely performance-based, and our NEOs are not guaranteed any minimum levels of payment under that plan. •2023ProxyStatement 53

2023 Annual Report Page 60 Page 62

2023 Annual Report Page 60 Page 62