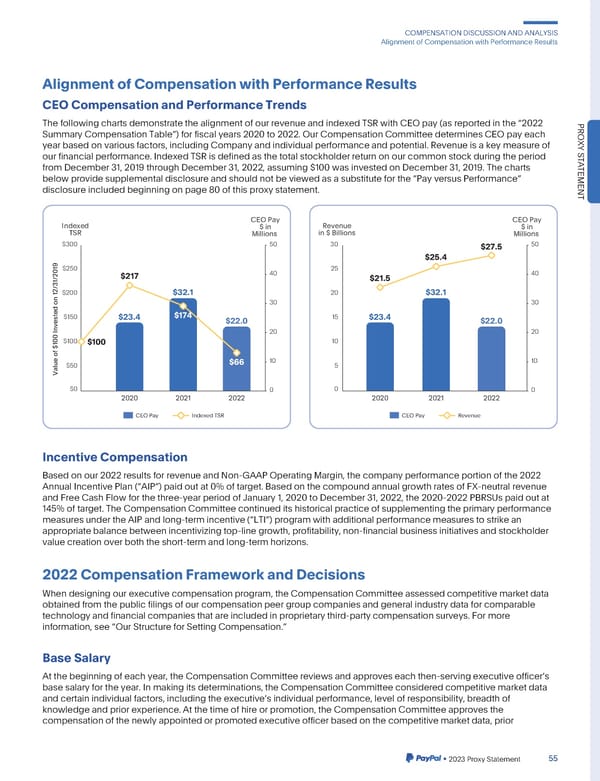

COMPENSATIONDISCUSSIONANDANALYSIS AlignmentofCompensationwithPerformanceResults AlignmentofCompensationwithPerformanceResults CEOCompensationandPerformanceTrends ThefollowingchartsdemonstratethealignmentofourrevenueandindexedTSRwithCEOpay(asreportedinthe“2022 PRO SummaryCompensationTable”)forfiscalyears2020to2022.OurCompensationCommitteedeterminesCEOpayeach yearbasedonvariousfactors,includingCompanyandindividualperformanceandpotential.Revenueisakeymeasureof XY S ourfinancial performance.IndexedTSRisdefinedasthetotalstockholderreturnonourcommonstockduringtheperiod T A fromDecember31,2019throughDecember31,2022,assuming$100wasinvestedonDecember31,2019.Thecharts TEMENT belowprovidesupplementaldisclosureandshouldnotbeviewedasasubstituteforthe“PayversusPerformance” disclosureincludedbeginningonpage80ofthisproxystatement. Indexed CEO Pay Revenue CEO Pay TSR $ in in $ Billions $ in Millions Millions $300 50 30 $27.5 50 $25.4 $250 40 25 40 $217 $21.5 $200 $32.1 20 $32.1 30 30 $150 $23.4 $174 $22.0 15 $23.4 $22.0 20 20 $100 $100 10 $50 $66 10 5 10 Value of $100 Invested on 12/31/2019 $0 0 0 0 2020 2021 2022 2020 2021 2022 CEO Pay Indexed TSR CEO Pay Revenue IncentiveCompensation Basedonour2022resultsforrevenueandNon-GAAPOperatingMargin,thecompanyperformanceportionofthe2022 AnnualIncentivePlan(“AIP”)paidoutat0%oftarget.BasedonthecompoundannualgrowthratesofFX-neutralrevenue andFreeCashFlowforthethree-yearperiodofJanuary1,2020toDecember31,2022,the2020-2022PBRSUspaidoutat 145%oftarget.TheCompensationCommitteecontinueditshistoricalpracticeofsupplementingtheprimaryperformance measuresundertheAIPandlong-termincentive(“LTI”)programwithadditionalperformancemeasurestostrikean appropriatebalancebetweenincentivizingtop-linegrowth,profitability,non-financialbusinessinitiativesand stockholder valuecreationoverboththeshort-termandlong-termhorizons. 2022CompensationFrameworkandDecisions Whendesigningourexecutivecompensationprogram,theCompensationCommitteeassessedcompetitivemarketdata obtainedfromthepublicfilingsofourcompensationpeergroupcompaniesandgeneralindustrydataforcomparable technologyandfinancialcompaniesthatareincludedinproprietarythird-partycompensationsurveys.Formore information, see “Our Structure for Setting Compensation.” BaseSalary At the beginningof eachyear,theCompensationCommitteereviewsandapproveseachthen-servingexecutiveofficers basesalaryfortheyear.Inmakingitsdeterminations,theCompensationCommitteeconsideredcompetitivemarketdata andcertainindividualfactors,includingtheexecutivesindividualperformance,levelof responsibility,breadthof knowledgeandpriorexperience.Atthetimeofhireorpromotion,theCompensationCommitteeapprovesthe compensationofthenewlyappointedorpromotedexecutiveofficerbasedonthecompetitivemarketdata,prior •2023ProxyStatement 55

2023 Annual Report Page 62 Page 64

2023 Annual Report Page 62 Page 64