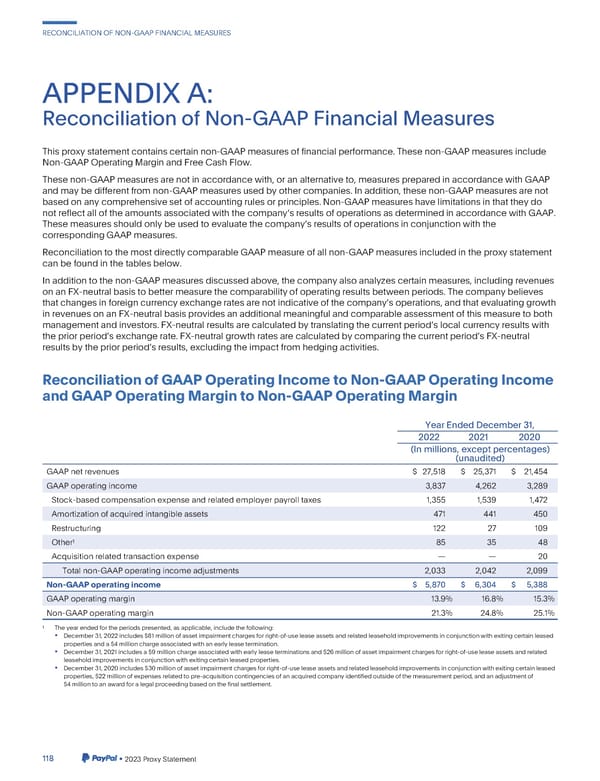

RECONCILIATIONOFNON-GAAPFINANCIALMEASURES APPENDIXA: Reconciliationof Non-GAAPFinancialMeasures This proxy statementcontainscertainnon-GAAPmeasuresoffinancialperformance.Thesenon-GAAPmeasuresinclude Non-GAAPOperatingMarginandFreeCashFlow. Thesenon-GAAPmeasuresarenotinaccordancewith,oranalternativeto,measurespreparedinaccordancewithGAAP andmaybedifferentfromnon-GAAPmeasuresusedbyothercompanies.Inaddition,thesenon-GAAPmeasuresarenot basedonanycomprehensivesetofaccountingrulesorprinciples.Non-GAAPmeasureshavelimitationsinthattheydo notreflect all of the amounts associatedwith the companysresults of operationsas determinedin accordancewith GAAP. Thesemeasuresshouldonlybeusedtoevaluatethecompanysresultsofoperationsinconjunctionwiththe correspondingGAAPmeasures. Reconciliationto the most directly comparableGAAPmeasureofallnon-GAAPmeasuresincludedintheproxystatement canbefoundinthetablesbelow. In addition to the non-GAAPmeasuresdiscussedabove,thecompanyalsoanalyzescertainmeasures,includingrevenues onanFX-neutralbasistobettermeasurethecomparabilityofoperatingresultsbetweenperiods.Thecompanybelieves that changesin foreigncurrencyexchangeratesarenotindicativeofthecompanysoperations,andthatevaluatinggrowth in revenuesonanFX-neutralbasisprovidesanadditionalmeaningfulandcomparableassessmentofthismeasuretoboth managementandinvestors.FX-neutralresultsarecalculatedbytranslatingthecurrentperiodslocalcurrencyresultswith theprior periods exchangerate.FX-neutralgrowthratesarecalculatedbycomparingthecurrentperiodsFX-neutral results by the prior periods results, excluding the impact from hedging activities. ReconciliationofGAAPOperatingIncometoNon-GAAPOperatingIncome andGAAPOperatingMargintoNon-GAAPOperatingMargin YearEndedDecember31, 2022 2021 2020 (In millions, except percentages) (unaudited) GAAPnetrevenues $ 27,518 $ 25,371 $ 21,454 GAAPoperatingincome 3,837 4,262 3,289 Stock-basedcompensationexpenseandrelatedemployerpayrolltaxes 1,355 1,539 1,472 Amortizationof acquired intangibleassets 471 441 450 Restructuring 122 27 109 1 Other 85 35 48 Acquisition related transaction expense — — 20 Total non-GAAPoperatingincomeadjustments 2,033 2,042 2,099 Non-GAAPoperatingincome $ 5,870 $ 6,304 $ 5,388 GAAPoperatingmargin 13.9% 16.8% 15.3% Non-GAAPoperatingmargin 21.3% 24.8% 25.1% 1 Theyearendedfortheperiodspresented,asapplicable,includethefollowing: • December31,2022includes$81millionofassetimpairmentchargesforright-of-useleaseassetsandrelatedleaseholdimprovementsinconjunctionwithexitingcertainleased propertiesanda$4millionchargeassociatedwithanearlyleasetermination. • December31,2021includesa$9millionchargeassociatedwithearlyleaseterminationsand$26millionofassetimpairmentchargesforright-of-useleaseassetsandrelated leaseholdimprovementsinconjunctionwithexitingcertainleasedproperties. • December31,2020includes$30millionofassetimpairmentchargesforright-of-useleaseassetsandrelatedleaseholdimprovementsinconjunctionwithexitingcertainleased properties, $22 million of expenses related to pre-acquisitioncontingenciesof an acquiredcompanyidentifiedoutsideof themeasurementperiod,andanadjustmentof $4milliontoanawardforalegalproceedingbasedonthefinalsettlement. 118 •2023ProxyStatement

2023 Annual Report Page 125 Page 127

2023 Annual Report Page 125 Page 127