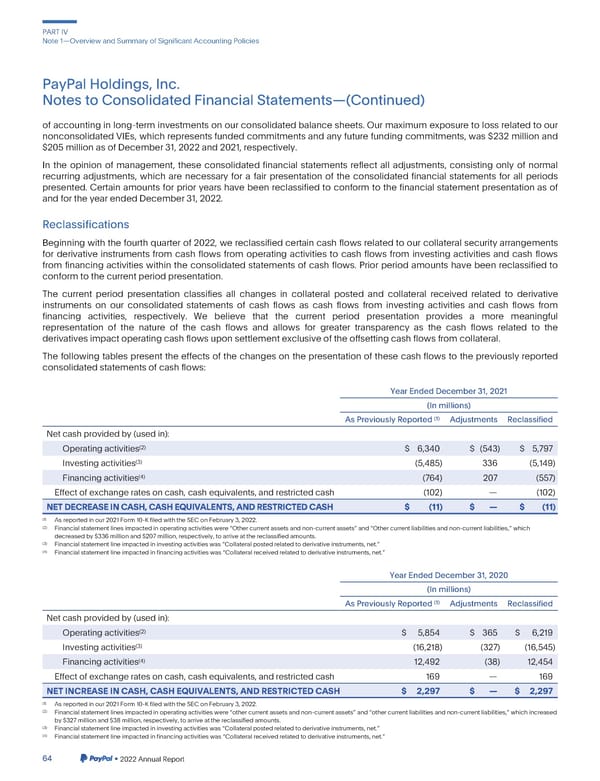

PARTIV Note1—OverviewandSummaryofSignificantAccountingPolicies PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) of accounting in long-term investments on our consolidated balance sheets. Our maximum exposure to loss related to our nonconsolidatedVIEs, which represents funded commitments and any future funding commitments, was $232 million and $205millionasofDecember31,2022and2021,respectively. In the opinion of management, these consolidated financial statements reflect all adjustments, consisting only of normal recurring adjustments, which are necessary for a fair presentation of the consolidated financial statements for all periods presented. Certain amounts for prior years have been reclassified to conform to the financial statement presentation as of andfortheyearendedDecember31,2022. Reclassifications Beginning with the fourth quarter of 2022, we reclassified certain cash flows related to our collateral security arrangements for derivative instruments from cash flows from operating activities to cash flows from investing activities and cash flows from financing activities within the consolidated statements of cash flows. Prior period amounts have been reclassified to conformtothecurrentperiodpresentation. The current period presentation classifies all changes in collateral posted and collateral received related to derivative instruments on our consolidated statements of cash flows as cash flows from investing activities and cash flows from financing activities, respectively. We believe that the current period presentation provides a more meaningful representation of the nature of the cash flows and allows for greater transparency as the cash flows related to the derivativesimpactoperatingcashflowsuponsettlementexclusiveoftheoffsettingcashflowsfromcollateral. The following tables present the effects of the changes on the presentation of these cash flows to the previously reported consolidatedstatementsofcashflows: YearEndedDecember31,2021 (In millions) AsPreviouslyReported(1) Adjustments Reclassified Netcashprovidedby(usedin): (2) Operatingactivities $ 6,340 $ (543) $ 5,797 (3) Investingactivities (5,485) 336 (5,149) (4) Financingactivities (764) 207 (557) Effect of exchangeratesoncash,cashequivalents,andrestrictedcash (102) — (102) NETDECREASEINCASH,CASHEQUIVALENTS,ANDRESTRICTEDCASH $ (11) $ — $ (11) (1) Asreportedinour2021Form10-KfiledwiththeSEConFebruary3,2022. (2) Financialstatementlinesimpactedinoperatingactivitieswere“Othercurrentassetsandnon-currentassets”and“Othercurrentliabilitiesandnon-currentliabilities,”which decreasedby$336millionand$207million,respectively,toarriveatthereclassifiedamounts. (3) Financialstatementlineimpactedininvestingactivitieswas “Collateralpostedrelatedtoderivativeinstruments,net.” (4) Financialstatementlineimpactedinfinancingactivitieswas “Collateralreceivedrelatedtoderivativeinstruments,net.” YearEndedDecember31,2020 (In millions) AsPreviouslyReported(1) Adjustments Reclassified Netcashprovidedby(usedin): (2) $ 5,854 $ 365 $ 6,219 Operatingactivities (3) (16,218) (327) (16,545) Investingactivities (4) 12,492 (38) 12,454 Financingactivities Effect of exchangeratesoncash,cashequivalents,andrestrictedcash 169 — 169 NETINCREASEINCASH,CASHEQUIVALENTS,ANDRESTRICTEDCASH $ 2,297 $ — $ 2,297 (1) Asreportedinour2021Form10-KfiledwiththeSEConFebruary3,2022. (2) Financialstatementlinesimpactedinoperatingactivitieswere“othercurrentassetsandnon-currentassets”and“othercurrentliabilitiesandnon-currentliabilities,”whichincreased by$327millionand$38million,respectively,toarriveatthereclassifiedamounts. (3) Financialstatementlineimpactedininvestingactivitieswas “Collateralpostedrelatedtoderivativeinstruments,net.” (4) Financialstatementlineimpactedinfinancingactivitieswas “Collateralreceivedrelatedtoderivativeinstruments,net.” 64 •2022AnnualReport

2023 Annual Report Page 211 Page 213

2023 Annual Report Page 211 Page 213