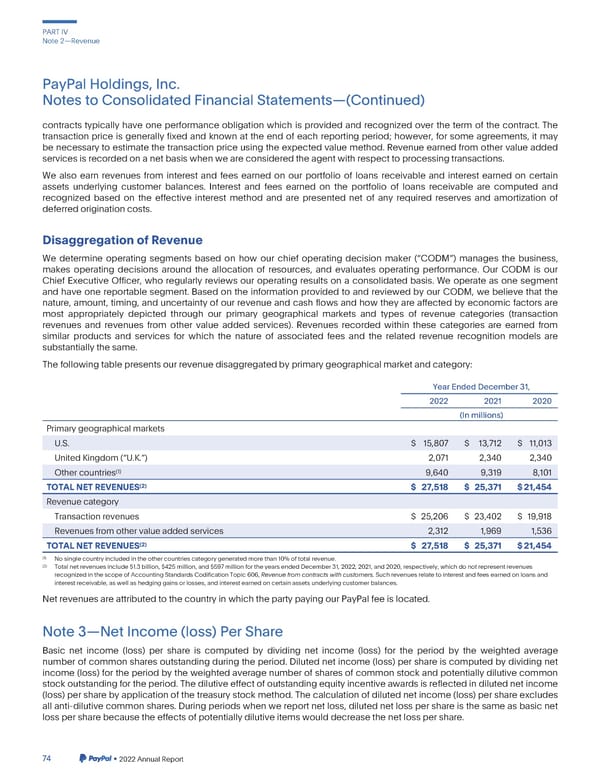

PARTIV Note2—Revenue PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) contracts typically have one performance obligation which is provided and recognized over the term of the contract. The transaction price is generally fixed and known at the end of each reporting period; however, for some agreements, it may benecessaryto estimate the transaction price using the expected value method. Revenue earned from other value added servicesis recordedonanetbasiswhenweareconsideredtheagentwithrespecttoprocessingtransactions. Wealso earn revenues from interest and fees earned on our portfolio of loans receivable and interest earned on certain assets underlying customer balances. Interest and fees earned on the portfolio of loans receivable are computed and recognized based on the effective interest method and are presented net of any required reserves and amortization of deferredoriginationcosts. DisaggregationofRevenue We determine operating segments based on how our chief operating decision maker (“CODM”) manages the business, makes operating decisions around the allocation of resources, and evaluates operating performance. Our CODM is our Chief Executive Officer, who regularly reviews our operating results on a consolidated basis. We operate as one segment and have one reportable segment. Based on the information provided to and reviewed by our CODM, we believe that the nature, amount, timing, and uncertainty of our revenue and cash flows and how they are affected by economic factors are most appropriately depicted through our primary geographical markets and types of revenue categories (transaction revenues and revenues from other value added services). Revenues recorded within these categories are earned from similar products and services for which the nature of associated fees and the related revenue recognition models are substantially the same. Thefollowingtablepresentsourrevenuedisaggregatedbyprimarygeographicalmarketandcategory: YearEndedDecember31, 2022 2021 2020 (In millions) Primarygeographicalmarkets U.S. $ 15,807 $ 13,712 $ 11,013 UnitedKingdom(“U.K.”) 2,071 2,340 2,340 (1) 9,640 9,319 8,101 Othercountries (2) TOTALNETREVENUES $ 27,518 $ 25,371 $21,454 Revenuecategory Transactionrevenues $ 25,206 $ 23,402 $ 19,918 Revenuesfromothervalueaddedservices 2,312 1,969 1,536 (2) $ 27,518 $ 25,371 $21,454 TOTALNETREVENUES (1) Nosinglecountryincludedintheothercountriescategorygeneratedmorethan10%oftotalrevenue. (2) Total net revenuesinclude$1.3 billion, $425 million, and $597 million for the years ended December 31, 2022, 2021, and 2020, respectively,which do not representrevenues recognizedinthescopeofAccountingStandardsCodificationTopic606,Revenuefromcontractswithcustomers.Suchrevenuesrelatetointerestandfeesearnedonloansand interest receivable, as well as hedging gains or losses, and interest earned on certain assets underlyingcustomer balances. NetrevenuesareattributedtothecountryinwhichthepartypayingourPayPalfeeislocated. Note3—NetIncome(loss)PerShare Basic net income (loss) per share is computed by dividing net income (loss) for the period by the weighted average numberofcommonsharesoutstandingduringtheperiod.Dilutednet income(loss) per share is computedby dividing net income(loss) for the period by the weighted average number of shares of common stock and potentially dilutive common stockoutstandingfortheperiod.Thedilutiveeffectofoutstandingequityincentiveawardsisreflectedindilutednetincome (loss) per share by application of the treasury stock method. The calculation of diluted net income (loss) per share excludes all anti-dilutive common shares. During periods when we report net loss, diluted net loss per share is the same as basic net loss per share becausetheeffectsof potentiallydilutive items would decreasethe net loss per share. 74 •2022AnnualReport

2023 Annual Report Page 221 Page 223

2023 Annual Report Page 221 Page 223