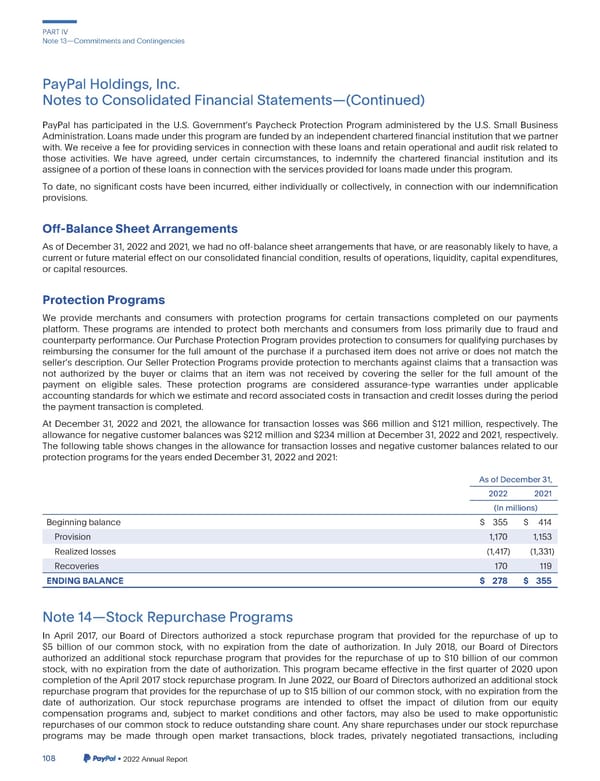

PARTIV Note13—CommitmentsandContingencies PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) PayPal has participated in the U.S. Governments Paycheck Protection Program administered by the U.S. Small Business Administration.Loans madeunderthisprogramarefundedbyanindependentcharteredfinancialinstitutionthatwepartner with. We receive a fee for providing services in connection with these loans and retain operational and audit risk related to those activities. We have agreed, under certain circumstances, to indemnify the chartered financial institution and its assigneeofaportionoftheseloansinconnectionwiththeservicesprovidedforloansmadeunderthisprogram. To date, no significant costs have been incurred, either individually or collectively, in connection with our indemnification provisions. Off-BalanceSheetArrangements AsofDecember31,2022and2021,wehadnooff-balancesheetarrangementsthathave,orarereasonablylikelytohave,a current or future material effect on our consolidated financial condition, results of operations, liquidity, capital expenditures, or capital resources. ProtectionPrograms We provide merchants and consumers with protection programs for certain transactions completed on our payments platform. These programs are intended to protect both merchants and consumers from loss primarily due to fraud and counterpartyperformance.Our PurchaseProtectionProgramprovidesprotectionto consumersfor qualifyingpurchasesby reimbursing the consumer for the full amount of the purchase if a purchased item does not arrive or does not match the sellers description. Our Seller Protection Programs provide protection to merchants against claims that a transaction was not authorized by the buyer or claims that an item was not received by covering the seller for the full amount of the payment on eligible sales. These protection programs are considered assurance-type warranties under applicable accountingstandardsfor whichweestimateandrecordassociatedcostsintransactionandcreditlossesduringtheperiod thepaymenttransactioniscompleted. At December 31, 2022 and 2021, the allowance for transaction losses was $66 million and $121 million, respectively. The allowancefor negative customer balances was $212 million and $234 million at December 31, 2022 and 2021, respectively. The following table shows changes in the allowance for transaction losses and negative customer balances related to our protectionprogramsfortheyearsendedDecember31,2022and2021: AsofDecember31, 2022 2021 (In millions) Beginningbalance $ 355 $ 414 Provision 1,170 1,153 Realizedlosses (1,417) (1,331) Recoveries 170 119 ENDINGBALANCE $ 278 $ 355 Note14—StockRepurchasePrograms In April 2017, our Board of Directors authorized a stock repurchase program that provided for the repurchase of up to $5 billion of our common stock, with no expiration from the date of authorization. In July 2018, our Board of Directors authorized an additional stock repurchase program that provides for the repurchase of up to $10 billion of our common stock, with no expiration from the date of authorization. This program became effective in the first quarter of 2020 upon completionof the April 2017 stock repurchase program. In June 2022, our Board of Directors authorized an additional stock repurchase program that provides for the repurchase of up to $15 billion of our common stock, with no expiration from the date of authorization. Our stock repurchase programs are intended to offset the impact of dilution from our equity compensation programs and, subject to market conditions and other factors, may also be used to make opportunistic repurchases of our common stock to reduce outstanding share count. Any share repurchases under our stock repurchase programs may be made through open market transactions, block trades, privately negotiated transactions, including 108 •2022AnnualReport

2023 Annual Report Page 255 Page 257

2023 Annual Report Page 255 Page 257