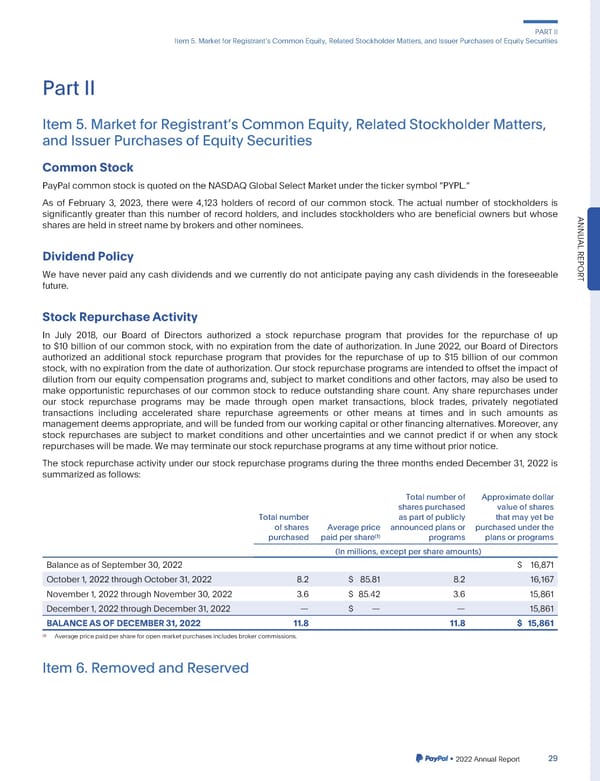

PARTII Item5.MarketforRegistrantsCommonEquity,RelatedStockholderMatters,andIssuerPurchasesofEquitySecurities Part II Item5.MarketforRegistrantsCommonEquity,RelatedStockholderMatters, andIssuerPurchasesofEquitySecurities CommonStock PayPalcommonstockisquotedontheNASDAQGlobalSelectMarketunderthetickersymbol“PYPL.” As of February 3, 2023, there were 4,123 holders of record of our common stock. The actual number of stockholders is significantly greater than this number of record holders, and includes stockholders who are beneficial owners but whose ANNU sharesareheldinstreetnamebybrokersandothernominees. AL DividendPolicy REPOR Wehaveneverpaid any cash dividends and we currently do not anticipate paying any cash dividends in the foreseeable T future. StockRepurchaseActivity In July 2018, our Board of Directors authorized a stock repurchase program that provides for the repurchase of up to $10 billion of our common stock, with no expiration from the date of authorization. In June 2022, our Board of Directors authorized an additional stock repurchase program that provides for the repurchase of up to $15 billion of our common stock, with no expiration from the date of authorization. Our stock repurchase programs are intended to offset the impact of dilution from our equity compensation programs and, subject to market conditions and other factors, may also be used to make opportunistic repurchases of our common stock to reduce outstanding share count. Any share repurchases under our stock repurchase programs may be made through open market transactions, block trades, privately negotiated transactions including accelerated share repurchase agreements or other means at times and in such amounts as managementdeemsappropriate,andwillbefundedfromourworkingcapitalorotherfinancingalternatives.Moreover,any stock repurchases are subject to market conditions and other uncertainties and we cannot predict if or when any stock repurchaseswillbemade.Wemayterminateourstockrepurchaseprogramsatanytimewithoutpriornotice. The stock repurchase activity under our stock repurchase programs during the three months ended December 31, 2022 is summarizedasfollows: Total numberof Approximatedollar sharespurchased valueofshares Total number aspartofpublicly that mayyetbe of shares Averageprice announcedplansor purchasedunderthe (1) purchased paidpershare programs plansorprograms (In millions, except per share amounts) BalanceasofSeptember30,2022 $ 16,871 October1,2022throughOctober31,2022 8.2 $ 85.81 8.2 16,167 November1,2022throughNovember30,2022 3.6 $ 85.42 3.6 15,861 December1,2022throughDecember31,2022 — $ — — 15,861 BALANCEASOFDECEMBER31,2022 11.8 11.8 $ 15,861 (1) Averagepricepaidpershareforopenmarketpurchasesincludesbrokercommissions. Item6.RemovedandReserved •2022AnnualReport 29

2023 Annual Report Page 176 Page 178

2023 Annual Report Page 176 Page 178