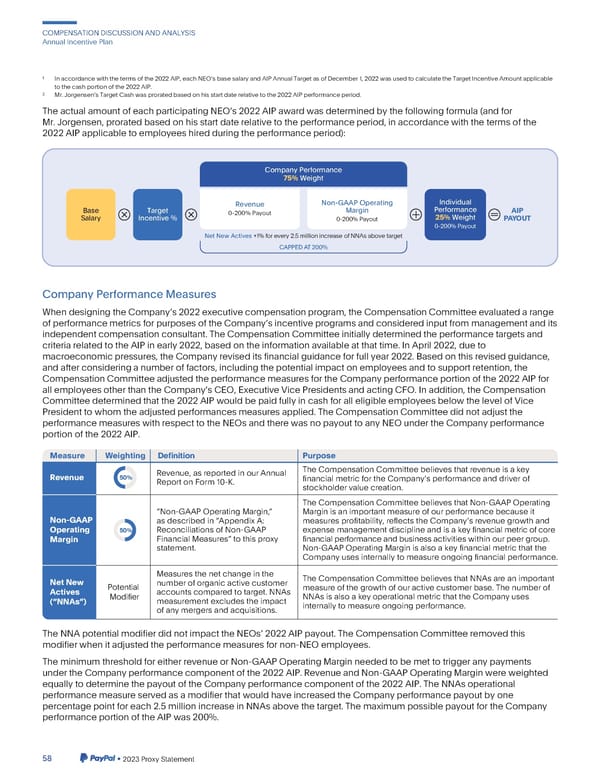

COMPENSATIONDISCUSSIONANDANALYSIS AnnualIncentivePlan 1 In accordancewiththetermsofthe2022AIP,eachNEOsbasesalaryandAIPAnnualTargetasofDecember1,2022wasusedtocalculatetheTargetIncentiveAmountapplicable to the cash portion of the 2022 AIP. 2 Mr. JorgensensTargetCashwasproratedbasedonhisstartdaterelativetothe2022AIPperformanceperiod. TheactualamountofeachparticipatingNEOs2022AIPawardwasdeterminedbythefollowingformula(andfor Mr. Jorgensen,proratedbasedonhisstartdaterelativetotheperformanceperiod,inaccordancewiththetermsofthe 2022AIPapplicabletoemployeeshiredduringtheperformanceperiod): Company Performance 75%Weight Revenue Non-GAAP Operating Individual Base Target 0-200% Payout Margin Performance AIP Salary Incentive % 0-200%Payout 25% Weight PAYOUT 0-200%Payout Net New Actives +1% for every 2.5millionincrease of NNAs above target CAPPEDAT 200% CompanyPerformanceMeasures WhendesigningtheCompanys2022executivecompensationprogram,theCompensationCommitteeevaluatedarange of performancemetricsforpurposesoftheCompanysincentiveprogramsandconsideredinputfrommanagementandits independentcompensationconsultant.TheCompensationCommitteeinitiallydeterminedtheperformancetargetsand criteria related to the AIP in early 2022, based on the information available at that time. In April 2022, due to macroeconomicpressures,theCompanyreviseditsfinancialguidanceforfullyear2022.Basedonthisrevisedguidance, andafterconsideringanumberoffactors,includingthepotentialimpactonemployeesandtosupportretention,the CompensationCommitteeadjustedtheperformancemeasuresfortheCompanyperformanceportionofthe2022AIPfor all employeesotherthantheCompanysCEO,ExecutiveVicePresidentsandactingCFO.Inaddition,theCompensation Committeedeterminedthatthe2022AIPwouldbepaidfullyincashforalleligibleemployeesbelowthelevelofVice Presidentto whomtheadjustedperformancesmeasuresapplied.TheCompensationCommitteedidnotadjustthe performancemeasureswithrespecttotheNEOsandtherewasnopayouttoanyNEOundertheCompanyperformance portion of the 2022 AIP. Measure Weighting Definition Purpose Revenue, as reported in our Annual The Compensation Committee believes that revenue is a key Revenue 50% Report on Form 10-K. financial metric for the Companys performance and driver of stockholder value creation. The Compensation Committee believes that Non-GAAP Operating “Non-GAAP Operating Margin,” Margin is an important measure of our performance because it Non-GAAP as described in “Appendix A: measures profitability, reflects the Companys revenue growth and Operating 50% Reconciliations of Non-GAAP expense management discipline and is a key financial metric of core Margin Financial Measures” to this proxy financial performance and business activities within our peer group. statement. Non-GAAP Operating Margin is also a key financial metric that the Company uses internally to measure ongoing financial performance. Measures the net change in the The Compensation Committee believes that NNAs are an important Net New Potential number of organic active customer measure of the growth of our active customer base. The number of Actives Modifier accounts compared to target. NNAs NNAs is also a key operational metric that the Company uses (“NNAs”) measurement excludes the impact internally to measure ongoing performance. of any mergers and acquisitions. TheNNApotentialmodifierdidnotimpacttheNEOs2022AIPpayout.TheCompensationCommitteeremovedthis modifierwhenitadjustedtheperformancemeasuresfornon-NEOemployees. TheminimumthresholdforeitherrevenueorNon-GAAPOperatingMarginneededtobemettotriggeranypayments undertheCompanyperformancecomponentofthe2022AIP.RevenueandNon-GAAPOperatingMarginwereweighted equally to determinethe payoutof the Companyperformancecomponentofthe2022AIP.TheNNAsoperational performancemeasureservedasamodifierthatwouldhaveincreasedtheCompanyperformancepayoutbyone percentagepointforeach2.5millionincreaseinNNAsabovethetarget.ThemaximumpossiblepayoutfortheCompany performanceportionoftheAIPwas200%. 58 •2023ProxyStatement

2023 Annual Report Page 65 Page 67

2023 Annual Report Page 65 Page 67