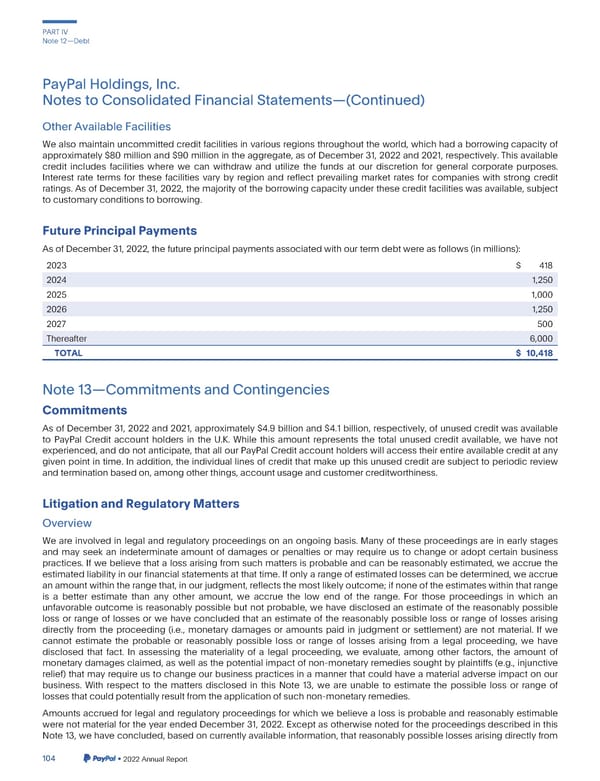

PARTIV Note12—Debt PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) OtherAvailableFacilities Wealsomaintain uncommitted credit facilities in various regions throughout the world, which had a borrowing capacity of approximately $80 million and $90 million in the aggregate, as of December 31, 2022 and 2021, respectively. This available credit includes facilities where we can withdraw and utilize the funds at our discretion for general corporate purposes. Interest rate terms for these facilities vary by region and reflect prevailing market rates for companies with strong credit ratings. As of December 31, 2022, the majority of the borrowing capacity under these credit facilities was available, subject to customaryconditionstoborrowing. FuturePrincipalPayments AsofDecember31,2022,thefutureprincipalpaymentsassociatedwithourtermdebtwereasfollows(inmillions): 2023 $ 418 2024 1,250 2025 1,000 2026 1,250 2027 500 Thereafter 6,000 TOTAL $ 10,418 Note13—CommitmentsandContingencies Commitments As of December 31, 2022 and 2021, approximately $4.9 billion and $4.1 billion, respectively, of unused credit was available to PayPal Credit account holders in the U.K. While this amount represents the total unused credit available, we have not experienced,and do not anticipate, that all our PayPal Credit account holders will access their entire available credit at any given point in time. In addition, the individual lines of credit that make up this unused credit are subject to periodic review andterminationbasedon,amongotherthings,accountusageandcustomercreditworthiness. LitigationandRegulatoryMatters Overview Weareinvolved in legal and regulatory proceedings on an ongoing basis. Many of these proceedings are in early stages and may seek an indeterminate amount of damages or penalties or may require us to change or adopt certain business practices. If we believe that a loss arising from such matters is probable and can be reasonably estimated, we accrue the estimatedliability in our financial statements at that time. If only a range of estimated losses can be determined, we accrue anamountwithintherangethat,inourjudgment,reflectsthemostlikelyoutcome;ifnoneoftheestimateswithinthatrange is a better estimate than any other amount, we accrue the low end of the range. For those proceedings in which an unfavorable outcome is reasonably possible but not probable, we have disclosed an estimate of the reasonably possible loss or range of losses or we have concluded that an estimate of the reasonably possible loss or range of losses arising directly from the proceeding (i.e., monetary damages or amounts paid in judgment or settlement) are not material. If we cannot estimate the probable or reasonably possible loss or range of losses arising from a legal proceeding, we have disclosed that fact. In assessing the materiality of a legal proceeding, we evaluate, among other factors, the amount of monetary damagesclaimed,as well as the potential impact of non-monetary remedies sought by plaintiffs (e.g., injunctive relief) that may require us to change our business practices in a manner that could have a material adverse impact on our business. With respect to the matters disclosed in this Note 13, we are unable to estimate the possible loss or range of lossesthatcouldpotentiallyresultfromtheapplicationof suchnon-monetaryremedies. Amounts accrued for legal and regulatory proceedings for which we believe a loss is probable and reasonably estimable werenot material for the year ended December 31, 2022. Except as otherwise noted for the proceedings described in this Note13, we have concluded,basedon currentlyavailable information, that reasonably possible losses arising directly from 104 •2022AnnualReport

2023 Annual Report Page 251 Page 253

2023 Annual Report Page 251 Page 253