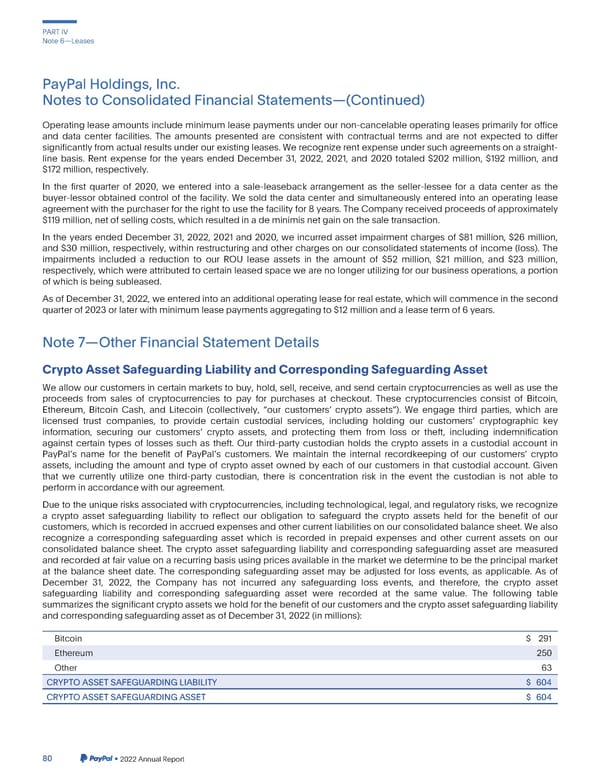

PARTIV Note6—Leases PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) Operating lease amounts include minimum lease payments under our non-cancelable operating leases primarily for office and data center facilities. The amounts presented are consistent with contractual terms and are not expected to differ significantly from actual results under our existing leases. We recognize rent expense under such agreements on a straight- line basis. Rent expense for the years ended December 31, 2022, 2021, and 2020 totaled $202 million, $192 million, and $172million, respectively. In the first quarter of 2020, we entered into a sale-leaseback arrangement as the seller-lessee for a data center as the buyer-lessor obtained control of the facility. We sold the data center and simultaneously entered into an operating lease agreementwiththepurchaserfortherightto usethefacilityfor 8 years.The Companyreceivedproceedsof approximately $119 million, net of selling costs, which resulted in a de minimis net gain on the sale transaction. In the years ended December 31, 2022, 2021 and 2020, we incurred asset impairment charges of $81 million, $26 million, and $30 million, respectively, within restructuring and other charges on our consolidated statements of income (loss). The impairments included a reduction to our ROU lease assets in the amount of $52 million, $21 million, and $23 million, respectively, which were attributed to certain leased space we are no longer utilizing for our business operations, a portion of whichis beingsubleased. AsofDecember31,2022,weenteredintoanadditionaloperatingleaseforrealestate,whichwillcommenceinthesecond quarter of 2023 or later with minimum lease paymentsaggregatingto $12 million and a lease term of 6 years. Note7—OtherFinancialStatementDetails CryptoAssetSafeguardingLiabilityandCorrespondingSafeguardingAsset Weallowourcustomersin certain markets to buy, hold, sell, receive, and send certain cryptocurrencies as well as use the proceeds from sales of cryptocurrencies to pay for purchases at checkout. These cryptocurrencies consist of Bitcoin, Ethereum, Bitcoin Cash, and Litecoin (collectively, “our customers crypto assets”). We engage third parties, which are licensed trust companies, to provide certain custodial services, including holding our customers cryptographic key information, securing our customers crypto assets, and protecting them from loss or theft, including indemnification against certain types of losses such as theft. Our third-party custodian holds the crypto assets in a custodial account in PayPals name for the benefit of PayPals customers. We maintain the internal recordkeeping of our customers crypto assets, including the amount and type of crypto asset owned by each of our customers in that custodial account. Given that we currently utilize one third-party custodian, there is concentration risk in the event the custodian is not able to performinaccordancewithouragreement. Duetotheuniquerisksassociatedwithcryptocurrencies,includingtechnological,legal, and regulatory risks, we recognize a crypto asset safeguarding liability to reflect our obligation to safeguard the crypto assets held for the benefit of our customers,whichis recordedin accruedexpensesandothercurrentliabilitieson our consolidatedbalancesheet.We also recognize a corresponding safeguarding asset which is recorded in prepaid expenses and other current assets on our consolidated balance sheet. The crypto asset safeguarding liability and corresponding safeguarding asset are measured andrecordedatfair value on a recurring basis using prices available in the market we determine to be the principal market at the balance sheet date. The corresponding safeguarding asset may be adjusted for loss events, as applicable. As of December 31, 2022, the Company has not incurred any safeguarding loss events, and therefore, the crypto asset safeguarding liability and corresponding safeguarding asset were recorded at the same value. The following table summarizesthesignificantcryptoassetsweholdforthebenefitofourcustomersandthecryptoassetsafeguardingliability andcorrespondingsafeguardingassetasofDecember31,2022(inmillions): Bitcoin $ 291 Ethereum 250 Other 63 CRYPTOASSETSAFEGUARDINGLIABILITY $ 604 CRYPTOASSETSAFEGUARDINGASSET $ 604 80 •2022AnnualReport

2023 Annual Report Page 227 Page 229

2023 Annual Report Page 227 Page 229