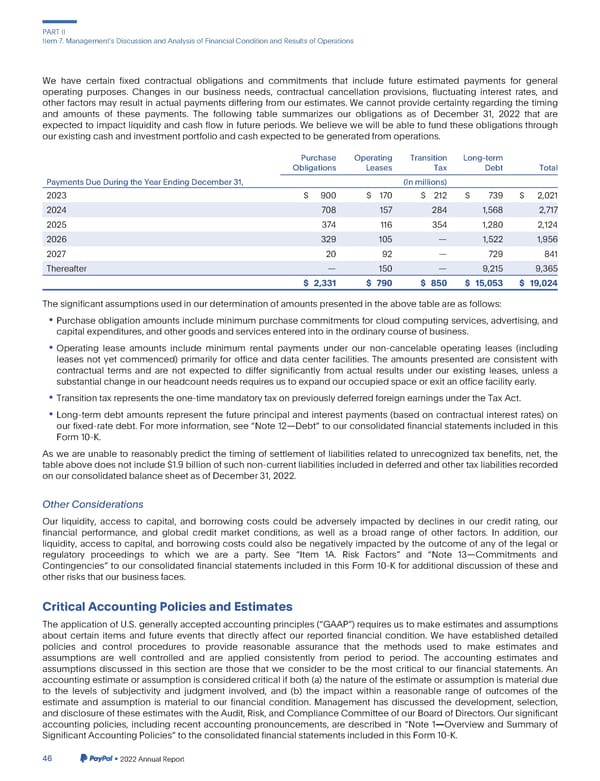

PARTII Item7. ManagementsDiscussionandAnalysisofFinancialConditionandResultsofOperations We have certain fixed contractual obligations and commitments that include future estimated payments for general operating purposes. Changes in our business needs, contractual cancellation provisions, fluctuating interest rates, and other factors may result in actual payments differing from our estimates. We cannot provide certainty regarding the timing and amounts of these payments. The following table summarizes our obligations as of December 31, 2022 that are expected to impact liquidity and cash flow in future periods. We believe we will be able to fund these obligations through ourexistingcashandinvestmentportfolioandcashexpectedtobegeneratedfromoperations. Purchase Operating Transition Long-term Obligations Leases Tax Debt Total PaymentsDueDuringtheYearEndingDecember31, (In millions) 2023 $ 900 $ 170 $ 212 $ 739 $ 2,021 2024 708 157 284 1,568 2,717 2025 374 116 354 1,280 2,124 2026 329 105 — 1,522 1,956 2027 20 92 — 729 841 Thereafter — 150 — 9,215 9,365 $ 2,331 $ 790 $ 850 $ 15,053 $ 19,024 Thesignificantassumptionsusedinourdeterminationofamountspresentedintheabovetableareasfollows: • Purchase obligation amounts include minimum purchase commitments for cloud computing services, advertising, and capital expenditures,and other goods and servicesenteredinto in the ordinarycourseof business. • Operating lease amounts include minimum rental payments under our non-cancelable operating leases (including leases not yet commenced) primarily for office and data center facilities. The amounts presented are consistent with contractual terms and are not expected to differ significantly from actual results under our existing leases, unless a substantial changein our headcountneedsrequiresustoexpandouroccupiedspaceorexitanofficefacilityearly. • Transition tax representsthe one-time mandatorytax on previouslydeferredforeignearningsundertheTax Act. • Long-term debt amounts represent the future principal and interest payments (based on contractual interest rates) on our fixed-rate debt. For more information, see “Note 12—Debt” to our consolidated financial statements included in this Form10-K. As we are unable to reasonably predict the timing of settlement of liabilities related to unrecognized tax benefits, net, the table abovedoesnotinclude$1.9billionofsuchnon-currentliabilitiesincludedindeferredandothertaxliabilitiesrecorded onourconsolidatedbalancesheetasofDecember31,2022. OtherConsiderations Our liquidity, access to capital, and borrowing costs could be adversely impacted by declines in our credit rating, our financial performance, and global credit market conditions, as well as a broad range of other factors. In addition, our liquidity, access to capital, and borrowing costs could also be negatively impacted by the outcome of any of the legal or regulatory proceedings to which we are a party. See “Item 1A. Risk Factors” and “Note 13—Commitments and Contingencies” to our consolidated financial statements included in this Form 10-K for additional discussion of these and otherrisks that our business faces. Critical AccountingPoliciesandEstimates Theapplication of U.S. generally accepted accounting principles (“GAAP”) requires us to make estimates and assumptions about certain items and future events that directly affect our reported financial condition. We have established detailed policies and control procedures to provide reasonable assurance that the methods used to make estimates and assumptions are well controlled and are applied consistently from period to period. The accounting estimates and assumptions discussed in this section are those that we consider to be the most critical to our financial statements. An accountingestimateor assumptionis consideredcriticalif both (a) the nature of the estimate or assumption is material due to the levels of subjectivity and judgment involved, and (b) the impact within a reasonable range of outcomes of the estimate and assumption is material to our financial condition. Management has discussed the development, selection, anddisclosureoftheseestimateswiththeAudit,Risk,andComplianceCommitteeofourBoardofDirectors.Oursignificant accounting policies, including recent accounting pronouncements, are described in “Note 1—Overview and Summary of Significant AccountingPolicies”to the consolidatedfinancialstatementsincludedin this Form 10-K. 46 •2022AnnualReport

2023 Annual Report Page 193 Page 195

2023 Annual Report Page 193 Page 195