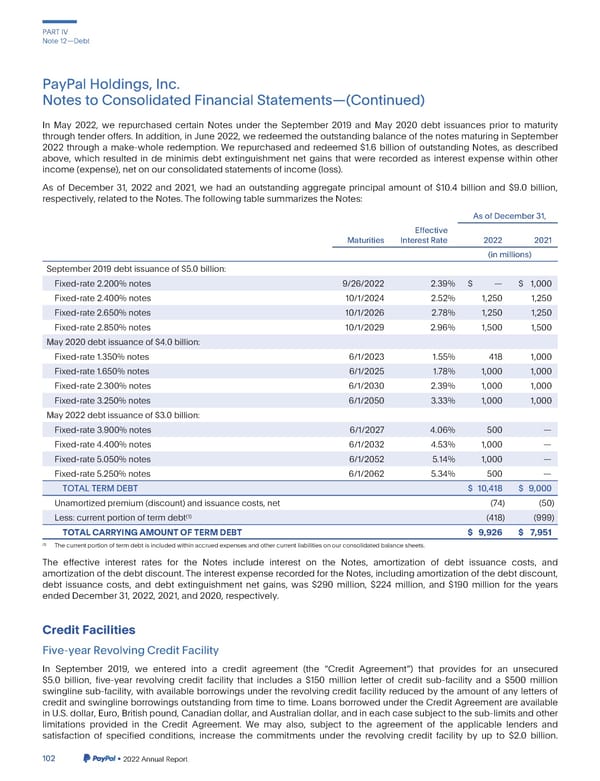

PARTIV Note12—Debt PayPalHoldings,Inc. NotestoConsolidatedFinancialStatements—(Continued) In May 2022, we repurchased certain Notes under the September 2019 and May 2020 debt issuances prior to maturity through tender offers. In addition, in June 2022, we redeemed the outstanding balance of the notes maturing in September 2022 through a make-whole redemption. We repurchased and redeemed $1.6 billion of outstanding Notes, as described above, which resulted in de minimis debt extinguishment net gains that were recorded as interest expense within other income(expense),netonourconsolidatedstatementsofincome(loss). As of December 31, 2022 and 2021, we had an outstanding aggregate principal amount of $10.4 billion and $9.0 billion, respectively,relatedto the Notes. The following table summarizesthe Notes: AsofDecember31, Effective Maturities Interest Rate 2022 2021 (in millions) September2019debtissuanceof$5.0billion: Fixed-rate2.200%notes 9/26/2022 2.39% $ — $ 1,000 Fixed-rate2.400%notes 10/1/2024 2.52% 1,250 1,250 Fixed-rate2.650%notes 10/1/2026 2.78% 1,250 1,250 Fixed-rate2.850%notes 10/1/2029 2.96% 1,500 1,500 May2020debtissuanceof$4.0billion: Fixed-rate1.350%notes 6/1/2023 1.55% 418 1,000 Fixed-rate1.650%notes 6/1/2025 1.78% 1,000 1,000 Fixed-rate2.300%notes 6/1/2030 2.39% 1,000 1,000 Fixed-rate3.250%notes 6/1/2050 3.33% 1,000 1,000 May2022debtissuanceof$3.0billion: Fixed-rate3.900%notes 6/1/2027 4.06% 500 — Fixed-rate4.400%notes 6/1/2032 4.53% 1,000 — Fixed-rate 5.050% notes 6/1/2052 5.14% 1,000 — Fixed-rate 5.250% notes 6/1/2062 5.34% 500 — TOTALTERMDEBT $ 10,418 $ 9,000 Unamortizedpremium(discount)andissuancecosts,net (74) (50) (1) (418) (999) Less: current portion of term debt TOTALCARRYINGAMOUNTOFTERMDEBT $ 9,926 $ 7,951 (1) Thecurrentportionoftermdebtisincludedwithinaccruedexpensesandothercurrentliabilitiesonourconsolidatedbalancesheets. The effective interest rates for the Notes include interest on the Notes, amortization of debt issuance costs, and amortization of the debt discount. The interest expense recorded for the Notes, including amortization of the debt discount, debt issuance costs, and debt extinguishment net gains, was $290 million, $224 million, and $190 million for the years endedDecember31,2022,2021,and2020,respectively. CreditFacilities Five-yearRevolvingCreditFacility In September 2019, we entered into a credit agreement (the “Credit Agreement”) that provides for an unsecured $5.0 billion, five-year revolving credit facility that includes a $150 million letter of credit sub-facility and a $500 million swingline sub-facility, with available borrowings under the revolving credit facility reduced by the amount of any letters of credit and swingline borrowings outstanding from time to time. Loans borrowed under the Credit Agreement are available in U.S. dollar, Euro, British pound, Canadian dollar, and Australian dollar, and in each case subject to the sub-limits and other limitations provided in the Credit Agreement. We may also, subject to the agreement of the applicable lenders and satisfaction of specified conditions, increase the commitments under the revolving credit facility by up to $2.0 billion. 102 •2022AnnualReport

2023 Annual Report Page 249 Page 251

2023 Annual Report Page 249 Page 251